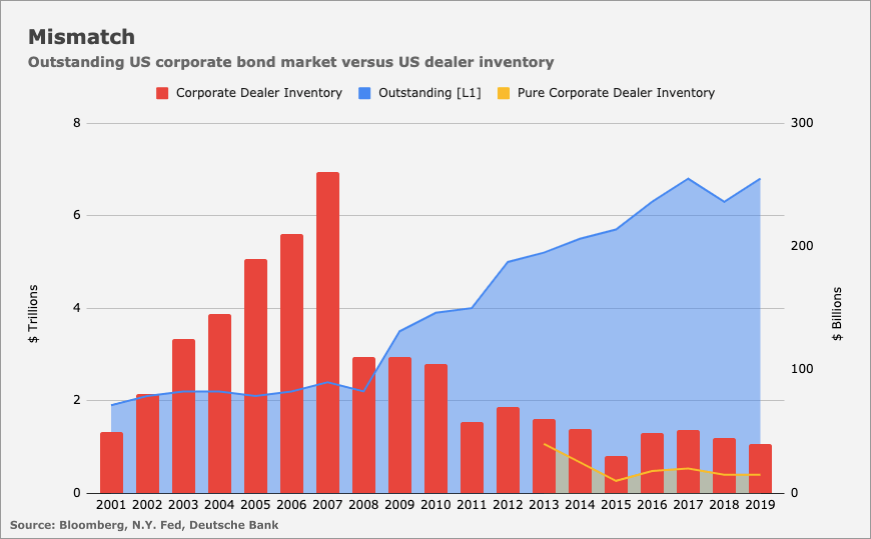

After the GFC (Global Financial Crisis), the new regulation reduce bank activity in markets. They stopped making the markets.

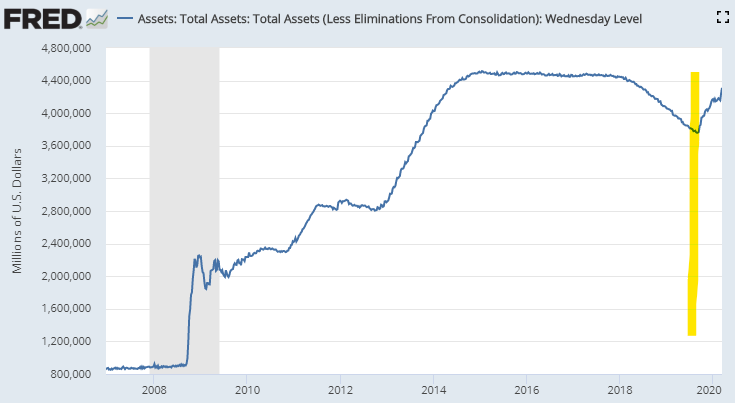

Now, as you can guess, someone saw the opportunity to pick pennies in front of a steamroller. That would be some hedge funds. That obviously require a lot of leverage, therefore they need a lot of liquidity. No issue here for a long time as the FED was pumping insane amount of money in the system.

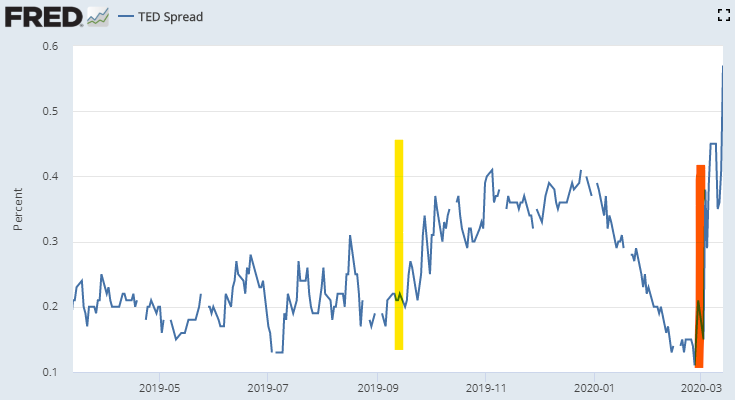

But in September 2019, the FED was reducing the amount of liquidity and the Treasury was sucking liquidity by borrowing money. The overnight repo jumped to a median of 5,25%.

The FED jumped in with a non-QE program, flooding again the market with liquidity.

But with the Covid-19, the stress is coming again and the market volatility is increasing thus asking to reduce the leverage. In the same time borrowing costs are eating all the profit.

The issue is, those hedge funds can’t repo directly with the FED.

We can expect a market with less arbitrage in the near future.

Less arbitrage and more volatility that a kind of market dislocation.

Comments are closed.