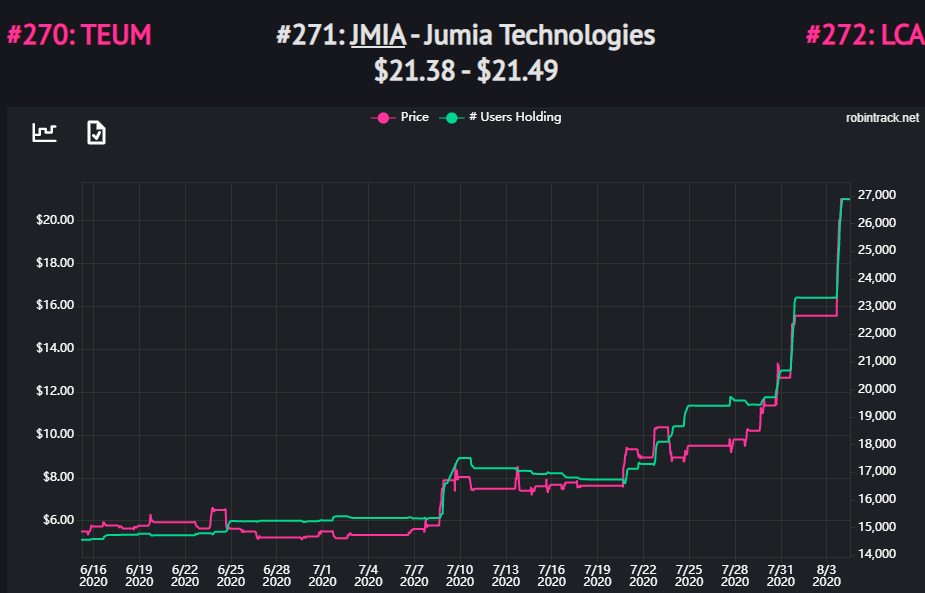

Being aware of the robinhood rallye is one thing. Experiencing it with a stock (Jumia) going from $2.7 to $27 in less than 6 months is different. Especially with a +100% in a week at the end. Below is a chart of the price of Jumia and the number of…

Financial Narratives

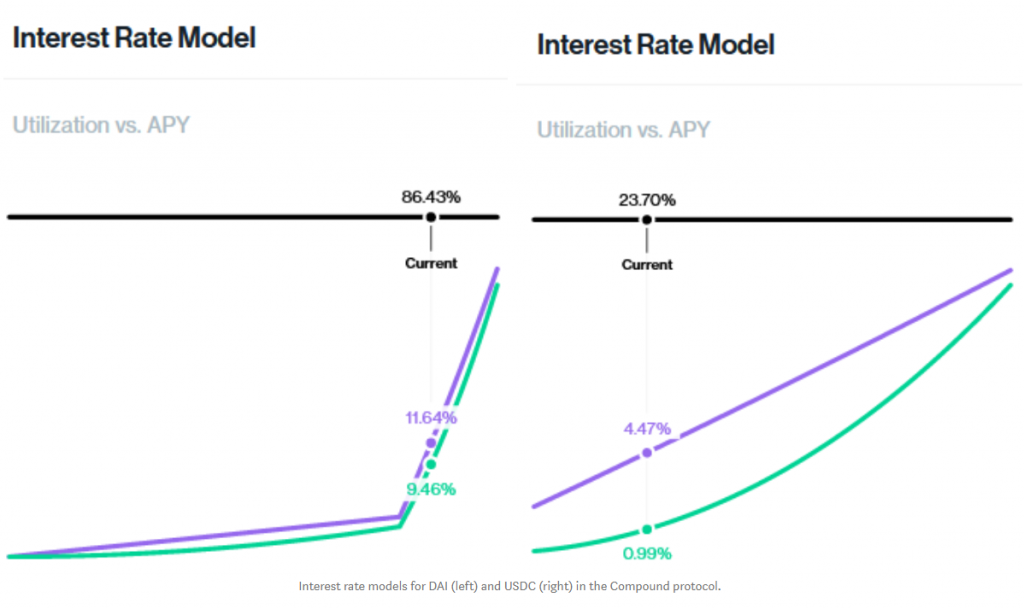

I advocated 2 years ago that stablecoins will see massive adoption. That true by market capitalization and by transactions volume. Interestingly, the big winner is still the unreliable Tether/USDT. There is 4 main players in the field : Tether (USDT) : somewhat backed by USD reserve Circle (USDC) : reserve backed Paxos (PAX, BUSD, HUSD)…

With bitcoin delivering an insane performance (+3400% over the last 5 years) and DeFi getting traction, maybe you want a guide to invest in this world? This is it. Before going in detail, let me state that nothing here is investment advice, it is merely an explanation of the blockchain…

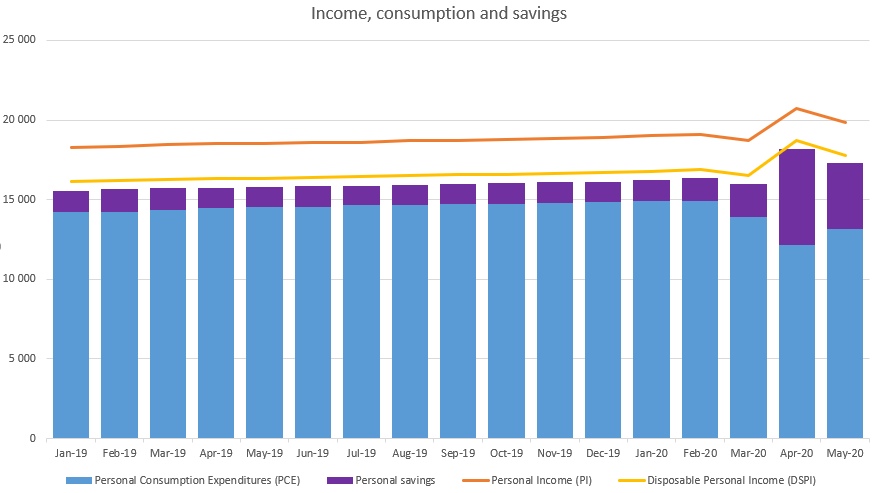

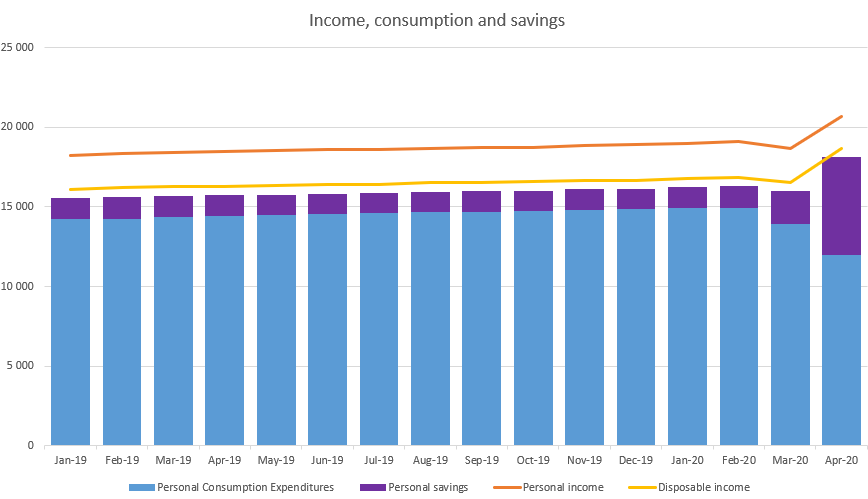

In line with last month data, While consumption is resuming, we are still a long shot from pre-Covid 19 levels (12% below). That’s when the stimulus package is still providing an effect. June will be the last month with the stimulus package. What can we expect next? Others ways to…

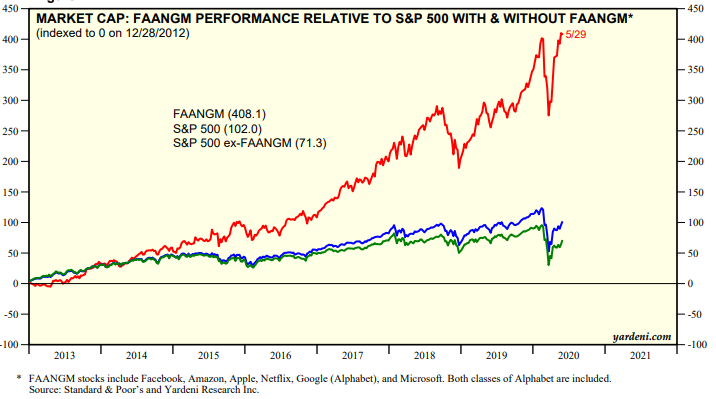

For year, the narrative was an outperformance of US over … well the rest of the world. Is that the real story? The narrative since the Covid-19 recovery is the leadership of the FAANGM stocks. Indeed, they now represent more than 20% of the SP500. Five stocks (excluding Netflix) that…

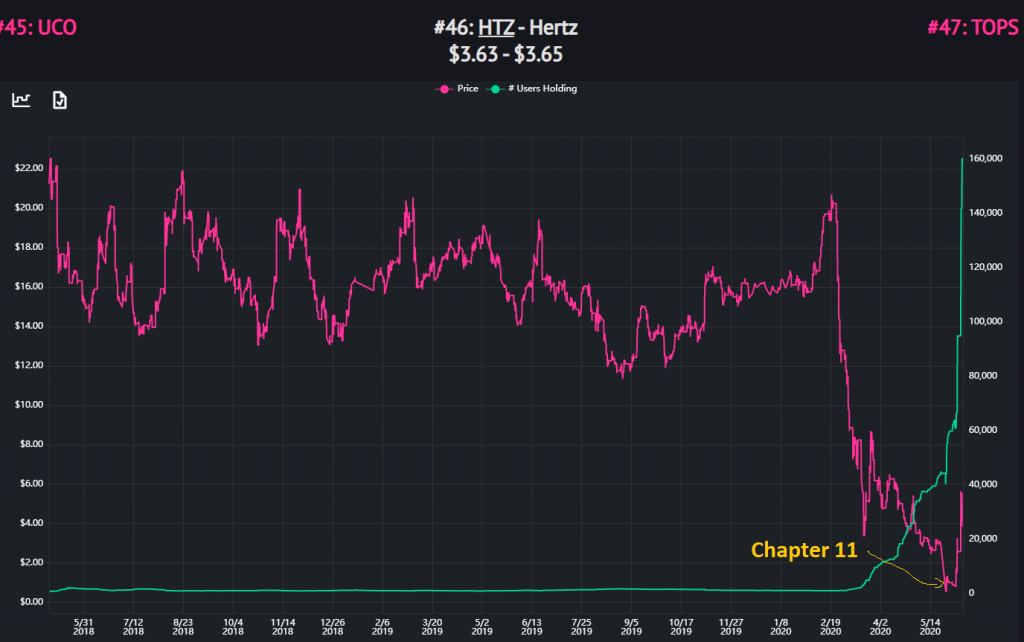

On this, still Covid-19, recovery, the main narrative is the push from retail towards the stock market. I already found that saving rates are going insane, in correlation with interest in stock and robinhood on Google Search and posted their impact on oil, bitcoin and Tesla. In this post, I…

In previous posts (regarding equities, oil and bitcoin), I proposed that the retail investor is marginal buyer that push price higher. In this post, I suggest evidence that it is the case. First, from the FRED database, we can see that the saving rate is at a whooping 33%. How…

FAANGM (Facebook, Amazon, Apple, Netflix, Google and Microsoft) are the new darling of the market and explain why there is such a discrepancy between the market and the general economy. Luckily for us Yardeni has compiled a great book of data on the subject. FAANGM stocks are now 24% of…

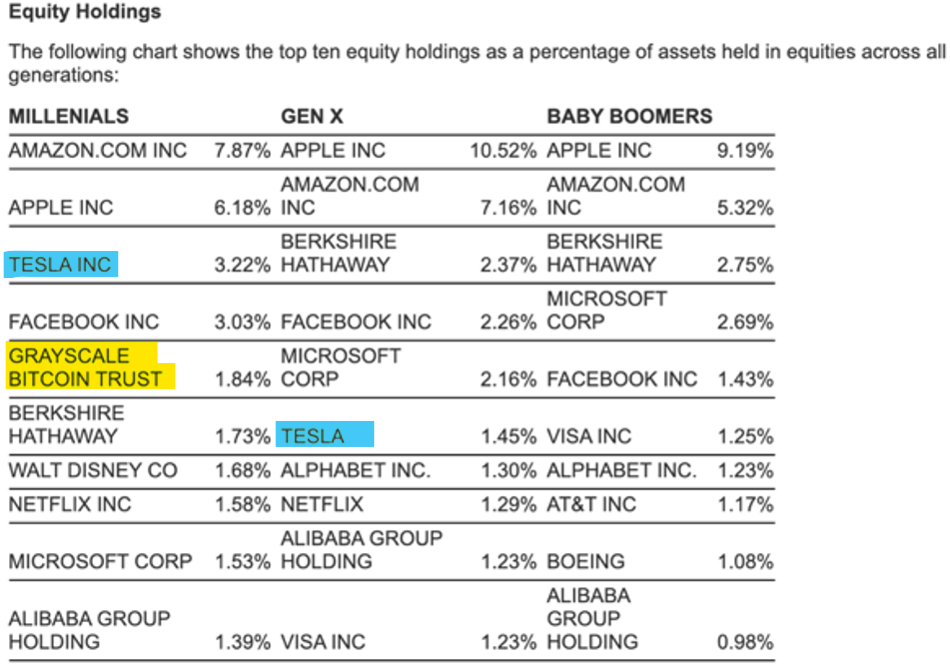

Who knew? The generation shit is a narrative for stock (or asset) picking. This Forbes article found a strange correlation between Tesla and Bitcoin and explain it because they have the same buyers, the millenials. While at some point Tesla is expected to be a productive asset, meaning fundamental should…

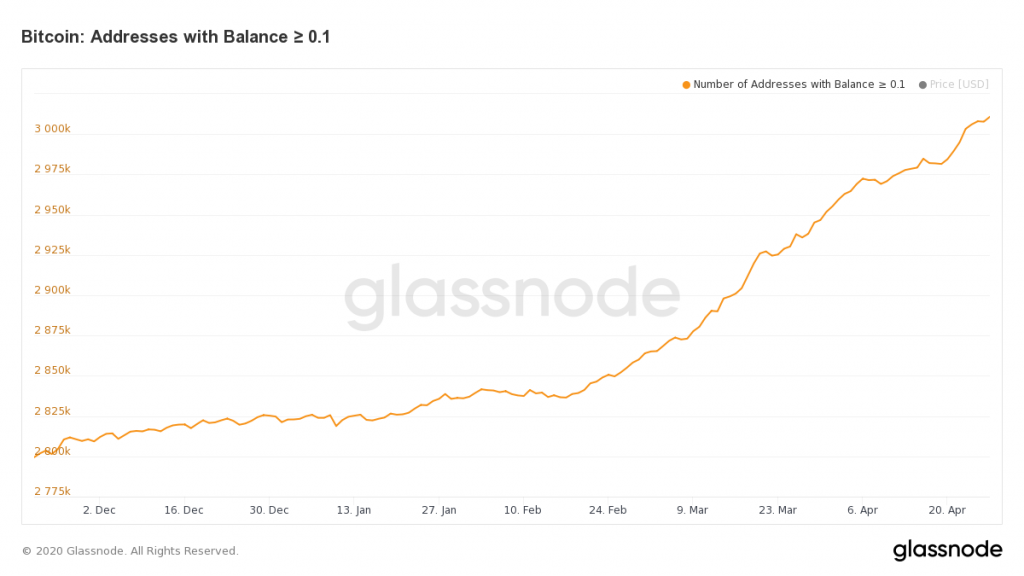

After saving the S&P500, speculating in the oil derivative market, the retail investors is still looking for ways to invest. This time I focus on bitcoin following this Coindesk article. The basis is a sharp increase of the number of bitcoin addresses with a balance > 0.1BTC (around $700) since…