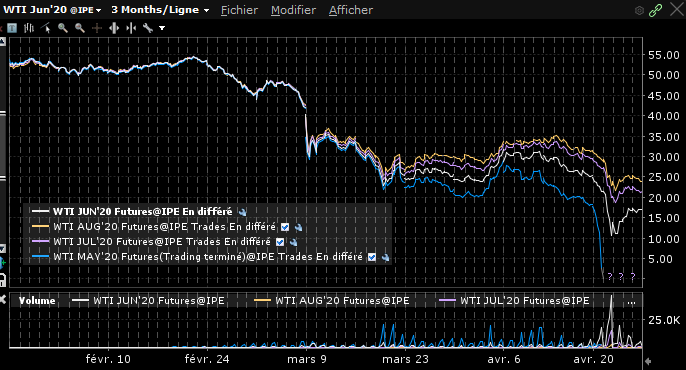

After bitcoin, shorting VIX, playing the Covid-19 rallye, the retail investors found a new interest in oil starting (and the USO ETP) April, 20 (first spike below) and mainly April, 21. That made sense, on April, 21 the May future for WTI ended at $-37 (pay attention to the minus…

Financial Narratives

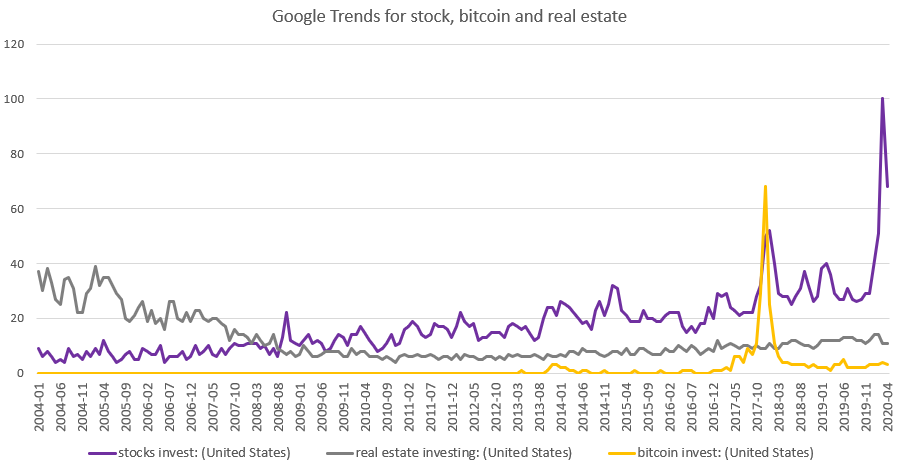

While some are prognosticating a greatest depression (and a worldwide recession is a given), the S&P500 and the stock market in general stay steady. A year was lost for the US index, much more on the European side. On the valuation side, the PER is 21 and the Shiller PER…

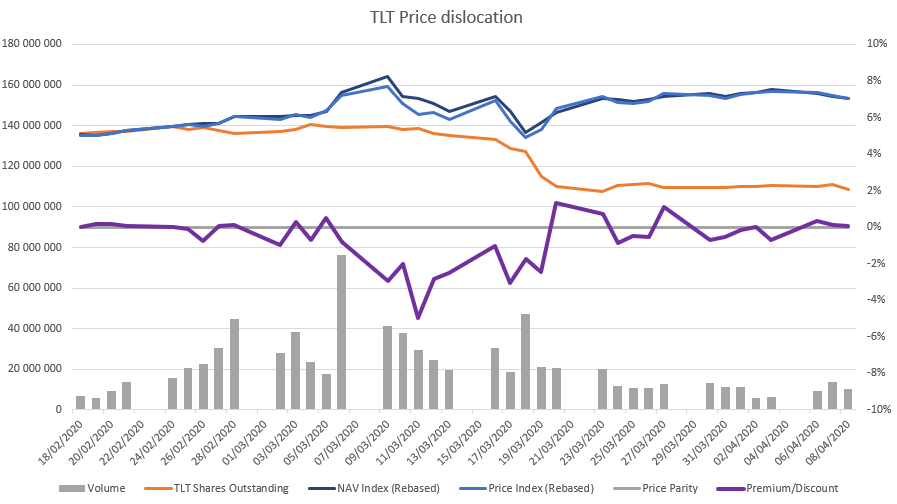

During the Covid-19, bonds ETF were under a stress and the ETF price started to diverge from the underlying NAV (Net Asset Value). Was the ETF price or the underlying NAV faulty? On the chart below, we can see that volume on TLT trading began to spike on March 6…

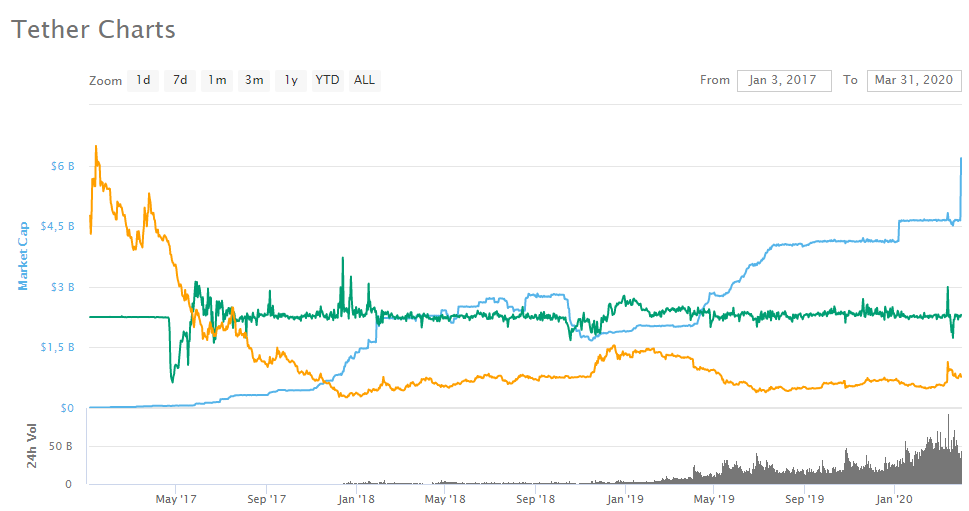

Tether is a digital currency that is backed by USD (1 USDT = 1 USD). The narrative around this token is that no one is really convince of the backing. I wrote, a year ago, that stablecoins are the future. Obviously, it has a lot to do with the fall…

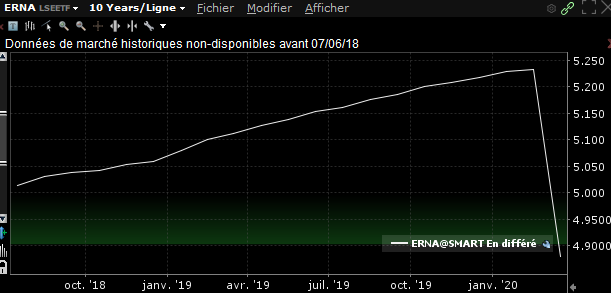

The current market dislocation provide some opportunities in bonds ETF. Big ETF trade are premium or discount because the underlying bonds are lacking of liquidity. ERNA is a US corporate investment grade ultra short term bonds trading on the London stock exchange. It is currently quoted $4.9 while the net…

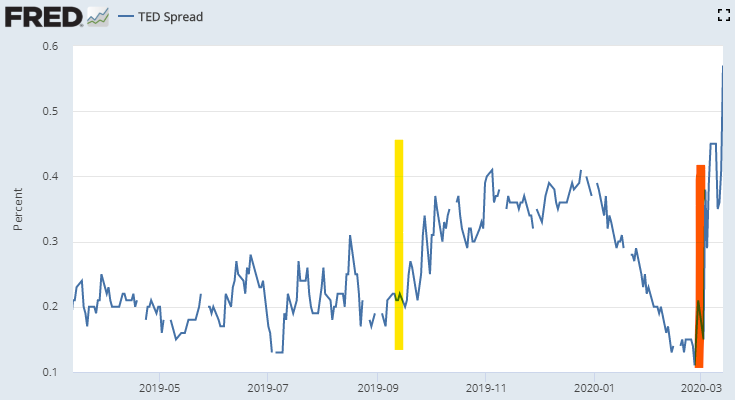

After the GFC (Global Financial Crisis), the new regulation reduce bank activity in markets. They stopped making the markets. Now, as you can guess, someone saw the opportunity to pick pennies in front of a steamroller. That would be some hedge funds. That obviously require a lot of leverage, therefore…

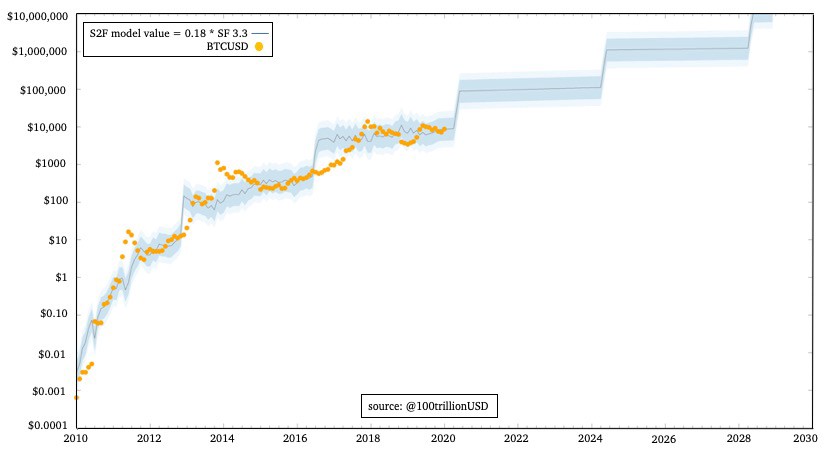

The bitcoin miner reward will halve in around 50 days (13 May). Regarding the scarcity model, the bitcoin price should increase to $55k (or around 10x from current prices). A paper discuss the efficient market hypothesis regarding this event. Indeed, we don’t see any sign of an increase in the…

The Bitcoin Scarcity model is a part of the Bitcoin as Digital Gold narrative. It try to extrapolate a theoretical value for bitcoin using it’s scarcity defined as : Scarcity = Stock / Flow In bitcoin, the flow is given by the mining reward which are halved, by design, at…

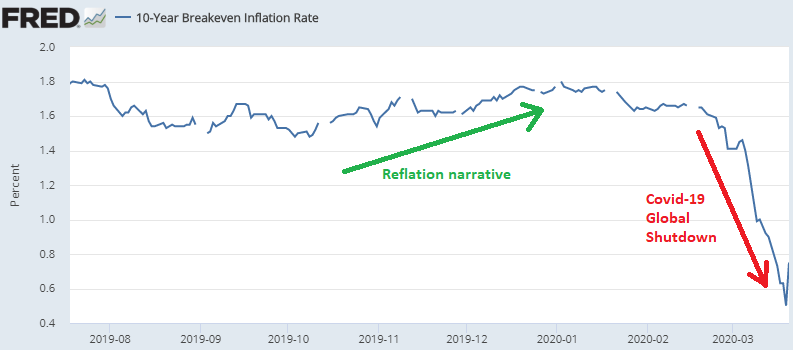

Not 6 month ago, a reflation narrative was taking place. That was obviously before the Covid-19 and the global shutdown. The 10-year breakeven inflation rate is the yield of the 10-year treasury bonds minus the yield of the 10-year treasury inflation-protected security. It’s the expected inflation over a 10 year…

It’s time for a bold forecast as I’m thinking about this for a week now. But before arguing why I think bitcoin is dead, let me say that I have nothing Bitcoin per se. I bought my first coins back in February 2015, a bitcoin was valued 191€. What a good…