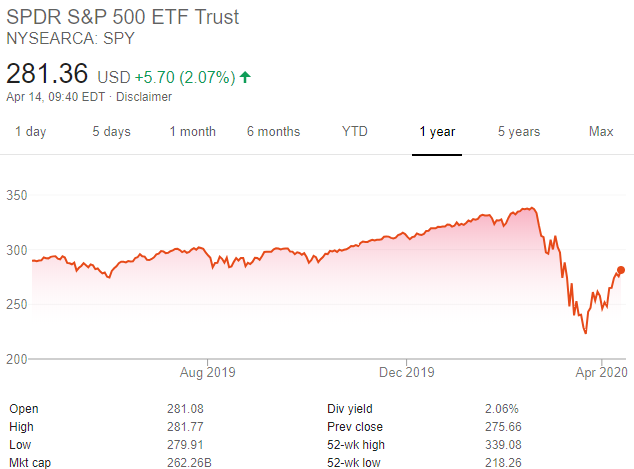

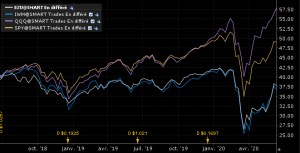

While some are prognosticating a greatest depression (and a worldwide recession is a given), the S&P500 and the stock market in general stay steady. A year was lost for the US index, much more on the European side.

On the valuation side, the PER is 21 and the Shiller PER is above 26. That’s using earnings for the previous year, and we can expect earnings to fall this year as most of the economy is in lockdown mode.

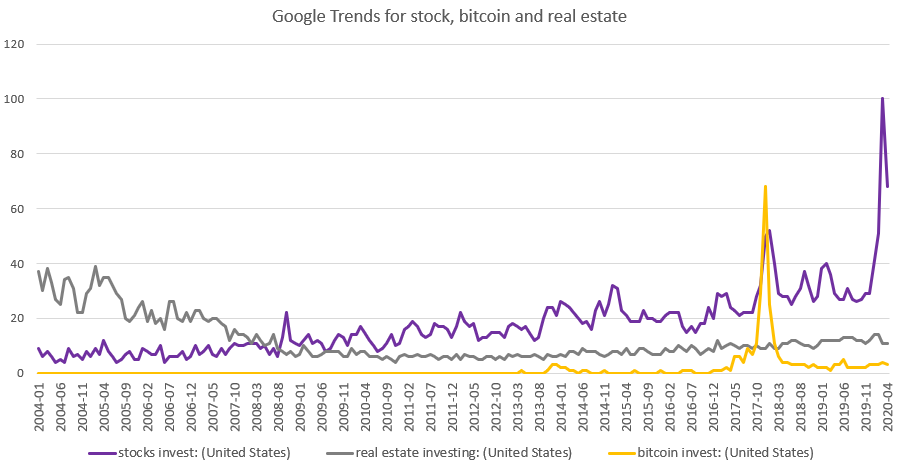

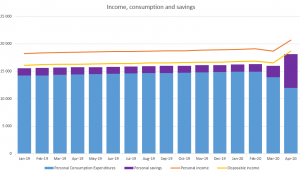

We know that risk parity funds were sellers as volatility as increased, stock buybacks is decreasing significantly. There isn’t so much active managers left to increase their exposure. One buyer might be the retail investor. Indeed, Google Trends shows that people are looking to invest in stocks and there is evidence that retails investors are opening trading accounts.

Now, is that a bargain when the shoeshine boy is rushing into the market? I doubt that. Notice how the previous spike was in December 2017/January 2018, the SPY was parabolic before … well crashing.

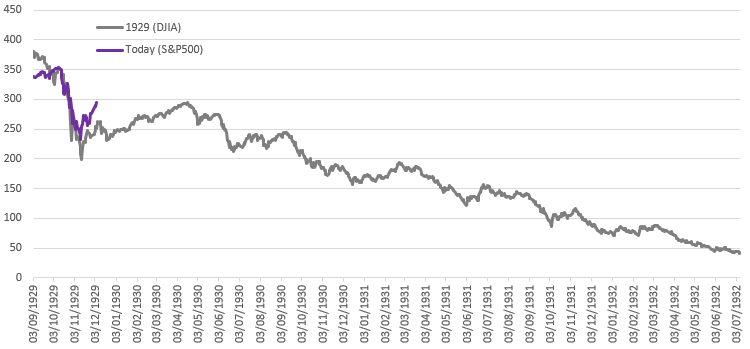

Moreover, I see a lot of expert waiting for a new bottom explaining the retracement with Fibonacci retracement (not that I trust this technical stuff) and similarities with 1929.

Will the Fed put (FED buying S&P500 ETFs) save the retail investors? I can’t wait.

PS : An infographic showing retail activity increased in France. I personally find interesting the 40% of rejected applications due to lack of market understanding for IG Market.

Comments are closed.