For year, the narrative was an outperformance of US over … well the rest of the world. Is that the real story?

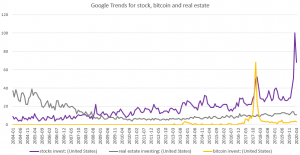

The narrative since the Covid-19 recovery is the leadership of the FAANGM stocks. Indeed, they now represent more than 20% of the SP500. Five stocks (excluding Netflix) that represent 20% of a 500 stock index!

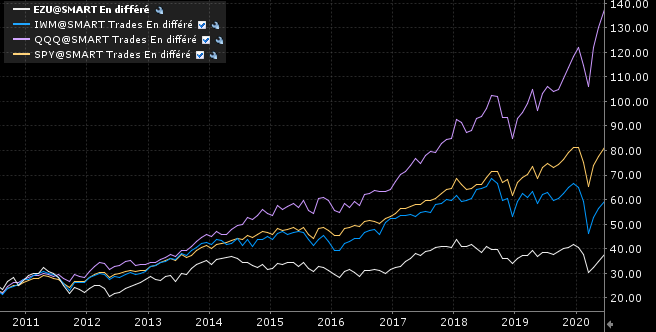

Let’s dig a bit using the Russell 2000 index that represent the biggest 2000 stocks of the US market but with an equal weight (instead of a market size weight). That reduce the impact of some stocks and better represent the whole market. The ETF ticker is IWM.

We will compare that will the MSCI Eurozone (ticker EZU) and the usual S&P500 (SPY) and Nasdaq 100 to represent tech stocks (QQQ).

Over the lifespan of the Covid-19 crisis, the IWM (blue) and EZU (white) are in line. No difference. While the tech stocks are at new highs, the “macro” ETFs have only retraced half of the loss.

On a period of 2 years, MSCI Eurozone (EZU, white line) and the Russell 2000 (IWM, blue line) are almost in line. Therefore, there is no superformance of the US economy over the last 2 years. Most of the superformance is located in some huge tech companies (FAANG).

Over a longer period, we find back the narrative of US dominance. Remember, in end 2011, the Eurozone was on brink of destruction.

On a fundamental standpoint, the PE ratio of EZU is 15.72 while IWM is 17.25. PB ratio are respectively 1.55 and 1.96. US is therefore a bit more expensive but it’s far below the SPY (PE 21.98 and PB 3.45).

There is two takeaways. First, the US market as a whole is no longer outperforming the Eurozone. Second, the tech narrative is the main driver of the market. It happens that most of those techs companies are in the US, and almost none in Europe.

Comments are closed.