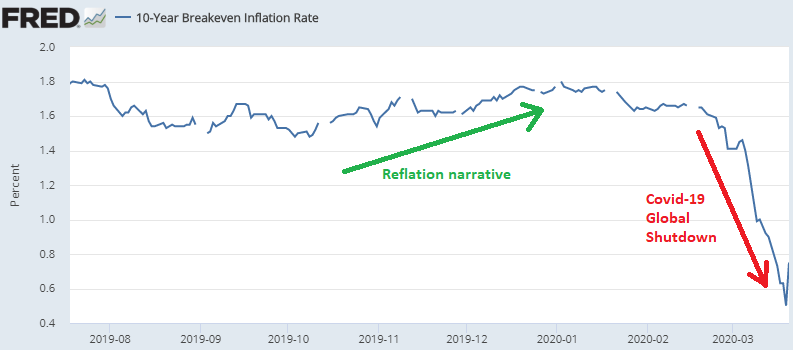

Not 6 month ago, a reflation narrative was taking place. That was obviously before the Covid-19 and the global shutdown. The 10-year breakeven inflation rate is the yield of the 10-year treasury bonds minus the yield of the 10-year treasury inflation-protected security. It’s the expected inflation over a 10 year period.

Notice that the FED is targeting an inflation around 2%. The market is basically saying that the FED will not be able to do so.

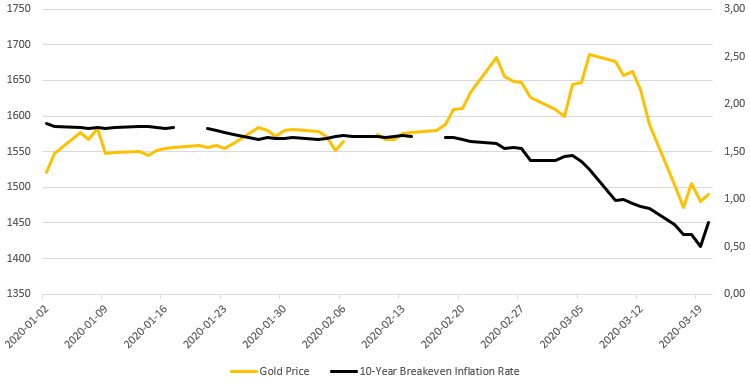

After an initial decorrelation (Gold being a safe haven), Gold fall in line.

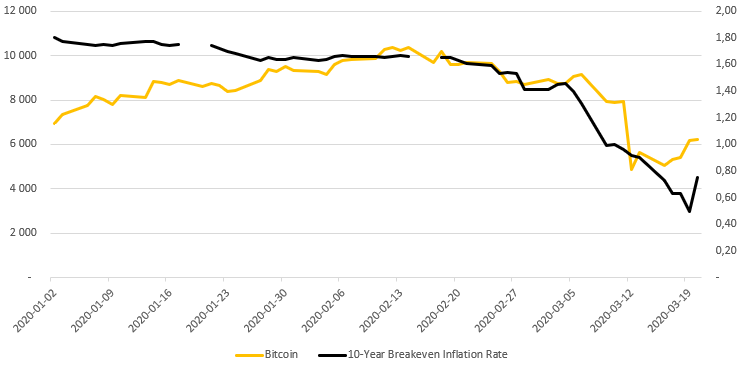

For Bitcoin, the safe haven didn’t materialize and the drop was faster albeit with a bit of lag.

Now, obviously, that was before a multi-trillions (with a T) program was launched across the globe. Can printing money stimulate inflation?

Be First to Comment