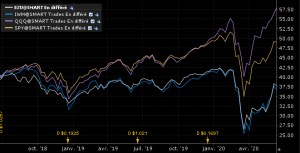

The current market dislocation provide some opportunities in bonds ETF. Big ETF trade are premium or discount because the underlying bonds are lacking of liquidity.

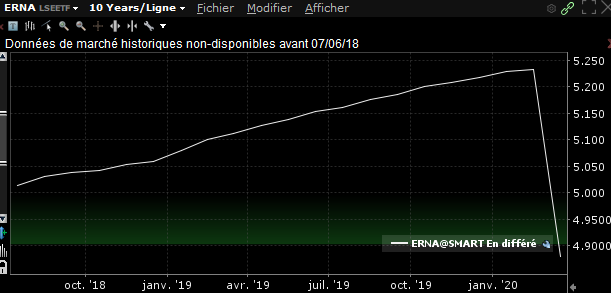

ERNA is a US corporate investment grade ultra short term bonds trading on the London stock exchange. It is currently quoted $4.9 while the net asset value (NAV) is $5.14. Almost a 5% discount.

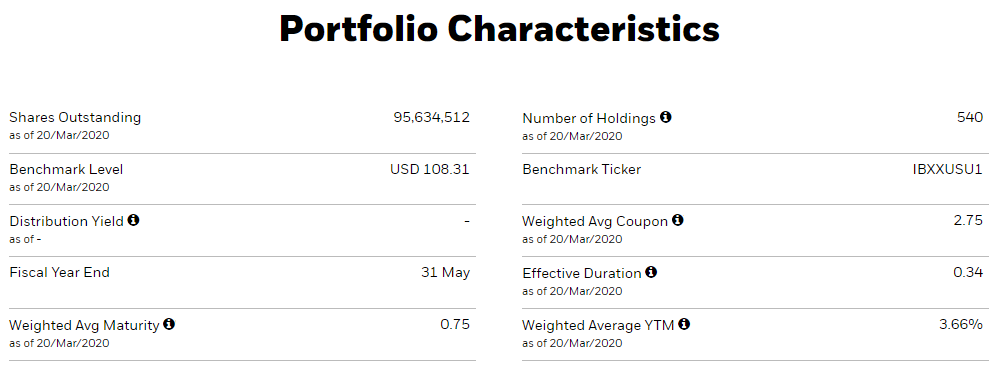

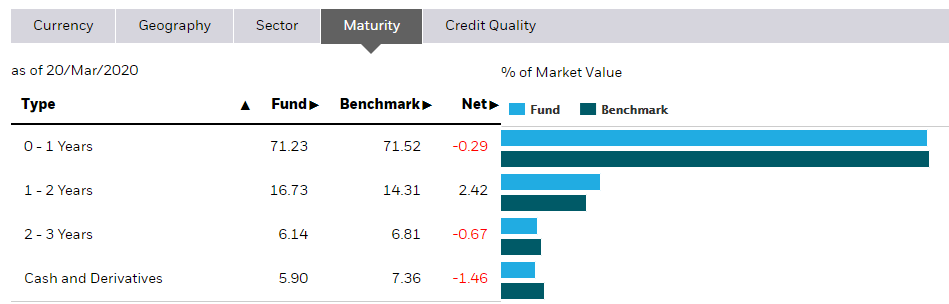

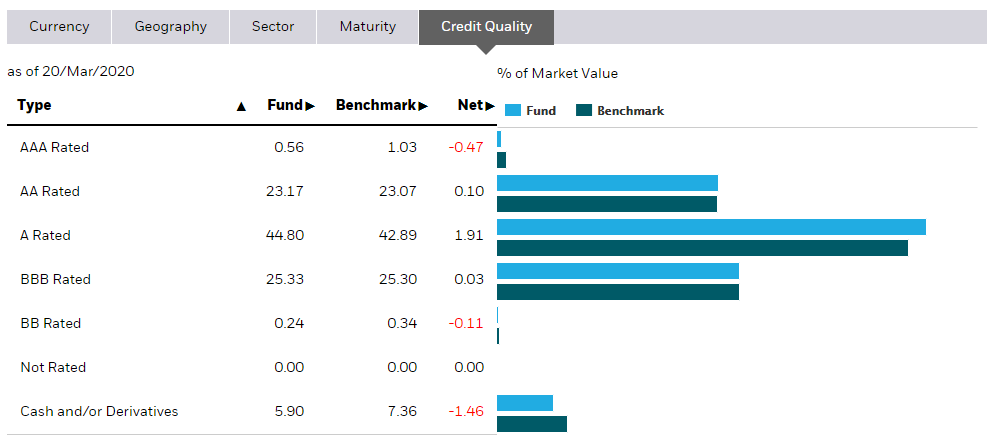

As you can see in the capture belows, the portfolio quality is quite high and maturity is ultra short (less than a year in average). It is unlikely that the NAV is wrong so much. The spread over similar US-bonds is higher that for longer dated bonds (LQD). A similar fund (NEAR) have a way smaller discount (but quoted on NYSE, much more liquid).

edit : the discount is decreasing at end of march. NAV is $5.15 and the last price was $5.05. There is no longer any discount on NEAR.

Comments are closed.