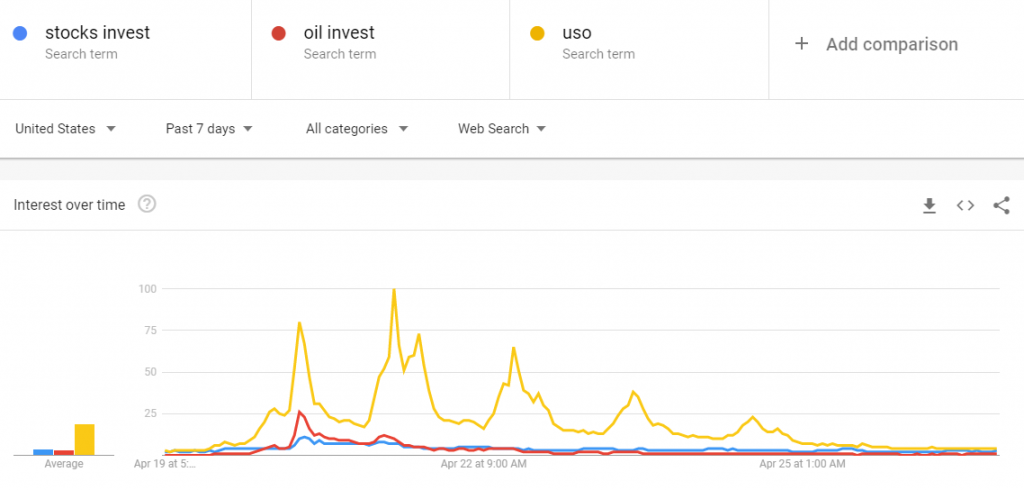

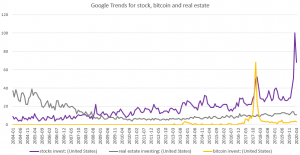

After bitcoin, shorting VIX, playing the Covid-19 rallye, the retail investors found a new interest in oil starting (and the USO ETP) April, 20 (first spike below) and mainly April, 21. That made sense, on April, 21 the May future for WTI ended at $-37 (pay attention to the minus sign).

Below is a Google Trend extract for some relevant keywords.

Now so far, playing a rallye didn’t paid, but who knows right?

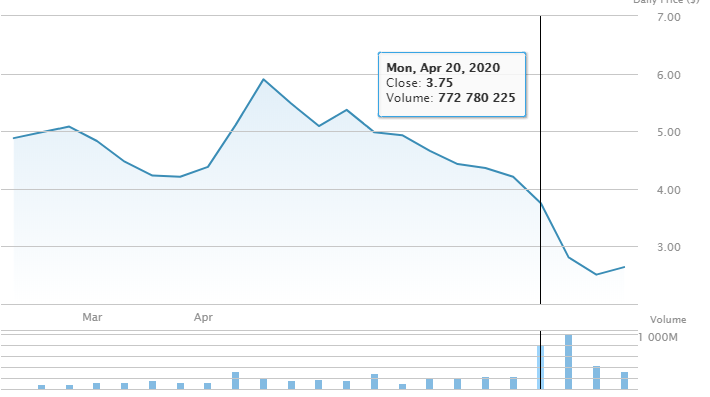

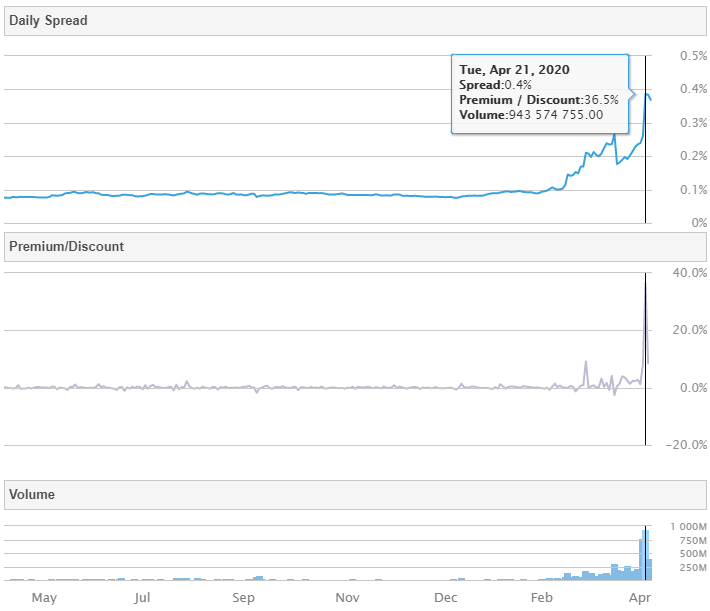

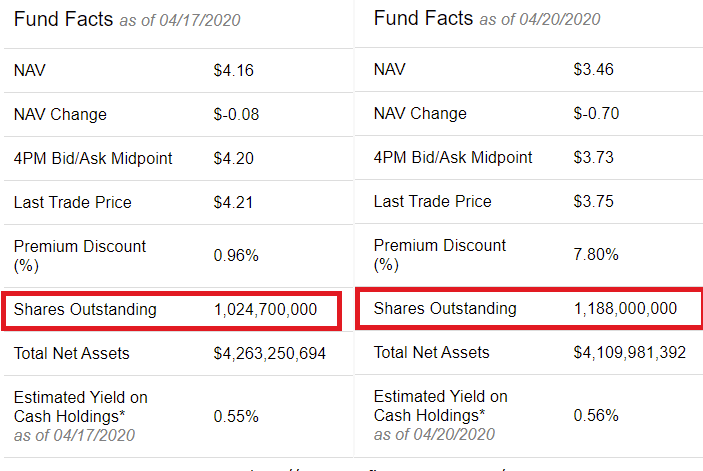

Anyway, so much interest drove volume, spread and discount on USO (8% premium on April 20).

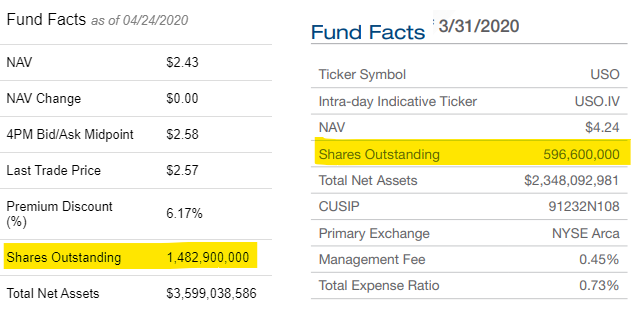

Now, you can have more volume and dislocation without having more interest. In this case, the fund is almost 3 times bigger than end of last month. That’s between 1 and 2 billions $ inflows.

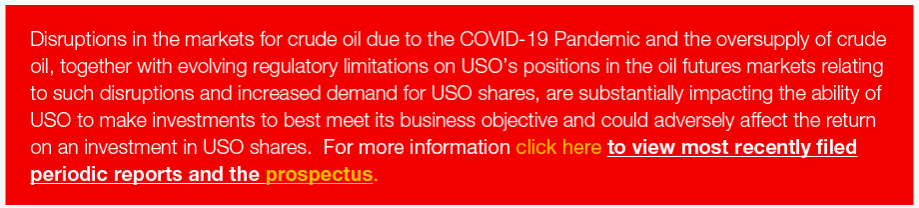

Even the fund manager feel the need to warn people.

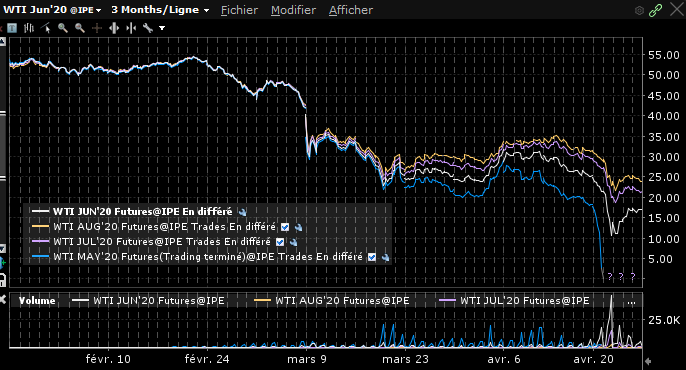

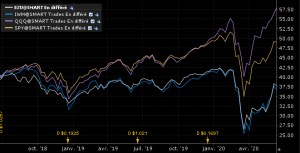

Now, here is the catch. There is no such thing as an immaterial oil barrel. There is a future, that deliver you a barrel each month. USO buy the first month future, then, before the contract expires, it sells it and buy the next month one. It sold the May contract (blue line below) between April 7 and April 13th to buy the June contract (white line below). You can see a $5 price difference. It’s the cost to roll the contract. Usually it’s not a big deal. It is when no one wants to find a barrel at the front door.

This contango effect will happen every month destroying 15-25% of the assets of USO until … well … oil storage is again possible (oil consumption resume).

The next future roll will be during May 5th and May 8th. USO would have owned half of the open interest contracts. But USO understood it was a target from hedge funds and changed its structure (or more precisely, CME ordered the change).

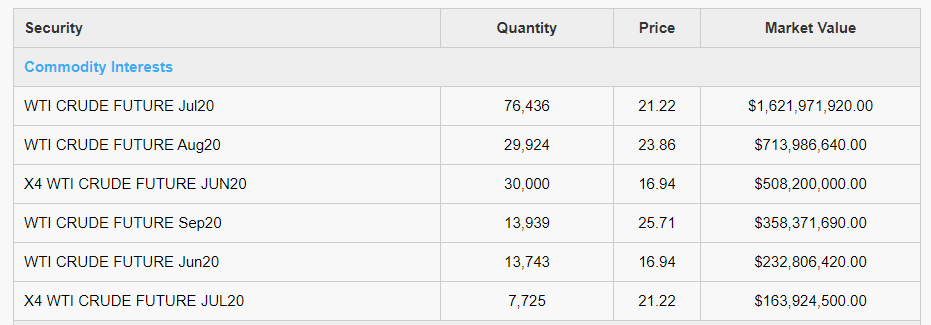

As of April 24, 2020, and for the reasons discussed below, USO may invest approximately 20% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the June futures contract, approximately 40% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the July contract, approximately 20% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the August contract, and approximately 20% of its portfolio in crude oil futures contracts on the NYMEX and ICE Futures in the September contract.

(..)

The April 23 CME Letter ordered USCF, USO and the related public funds not to assume a position in the light sweet crude oil futures contract for June 2020 in excess of 15,000 long futures contracts, for July 2020 in 78,000 long futures contracts, for August 2020 in 50,000 long futures contracts, for September 2020 in 35,000 long futures contracts

Moreover, the fund can now invest in other oil related product in order to further dislocate the oil market.

Nevertheless, what can happen if all USO investors want to close their trades. Wanna bet?

Holdings as of 04/24/2020

Comments are closed.