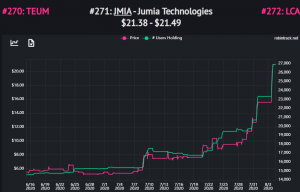

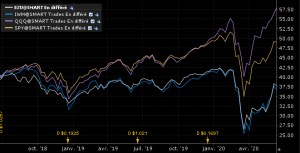

In previous posts (regarding equities, oil and bitcoin), I proposed that the retail investor is marginal buyer that push price higher. In this post, I suggest evidence that it is the case.

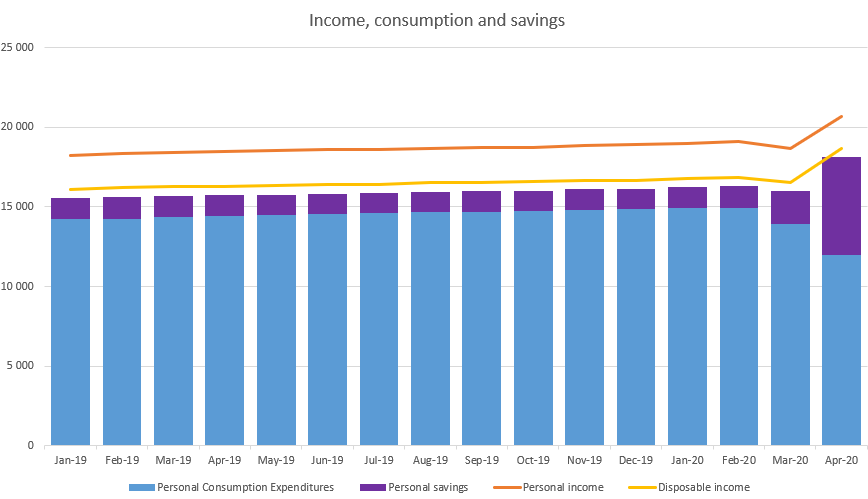

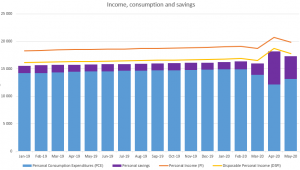

First, from the FRED database, we can see that the saving rate is at a whooping 33%. How can you save a third of your income when unemployment is at a all time high (since 1950) of 14.7%? Well it seems that income was higher as well thanks to unemployment benefit and the help of helicopter money.

As the economics theories expect, in time of uncertainty, you can(t force consumption (even more when you are in lockdown mode).

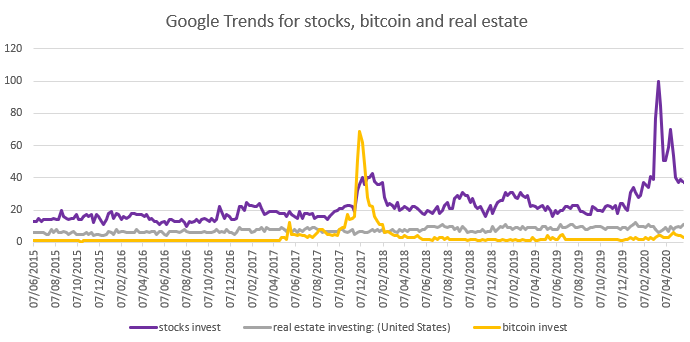

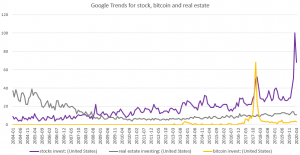

Looking in Google Trends, we can see a spike in stocks investing that stays elevated.

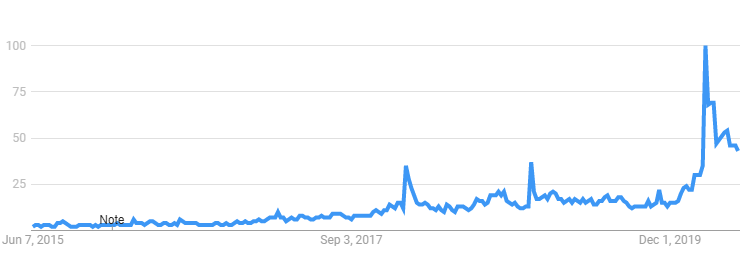

Robinhood (motto investing for everyone) interest is seeing a spike as well.

Is that sustainable? I doubt you can inflate personal income forever when GDP is contracting. We will see.

Comments are closed.