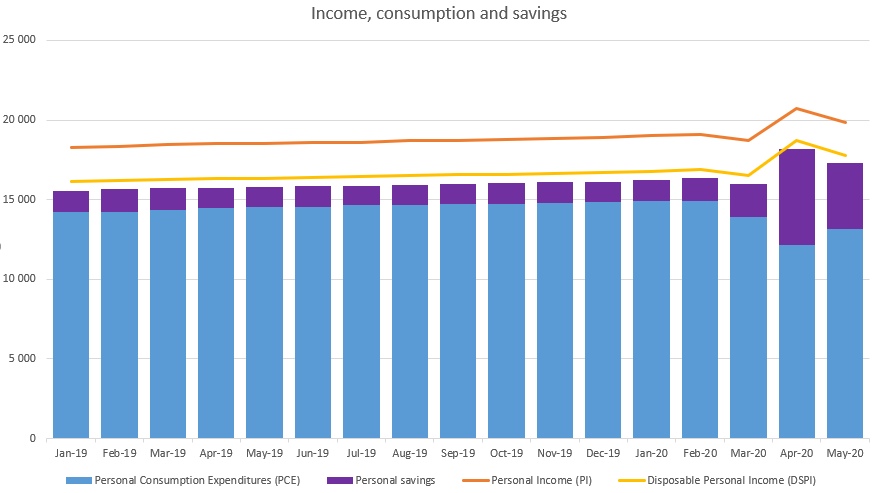

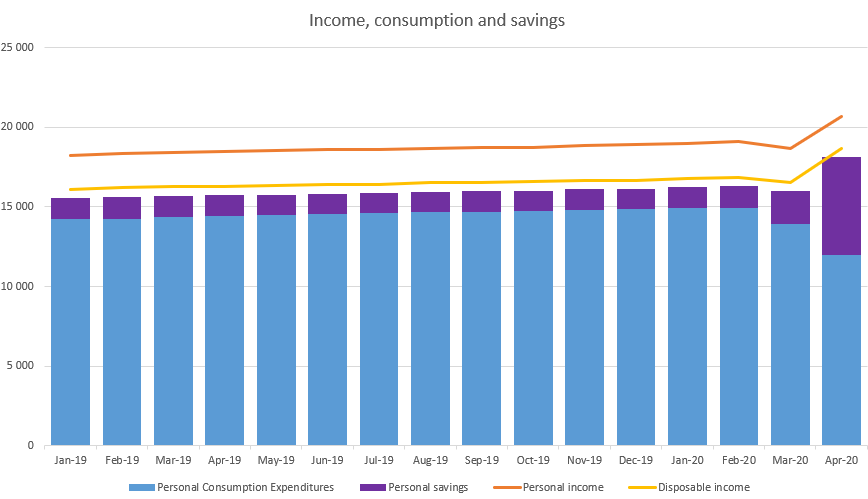

In line with last month data, While consumption is resuming, we are still a long shot from pre-Covid 19 levels (12% below). That’s when the stimulus package is still providing an effect. June will be the last month with the stimulus package. What can we expect next? Others ways to…

Posts published in “Stress”

For year, the narrative was an outperformance of US over … well the rest of the world. Is that the real story? The narrative since the Covid-19 recovery is the leadership of the FAANGM stocks. Indeed, they now represent more than 20% of the SP500. Five stocks (excluding Netflix) that…

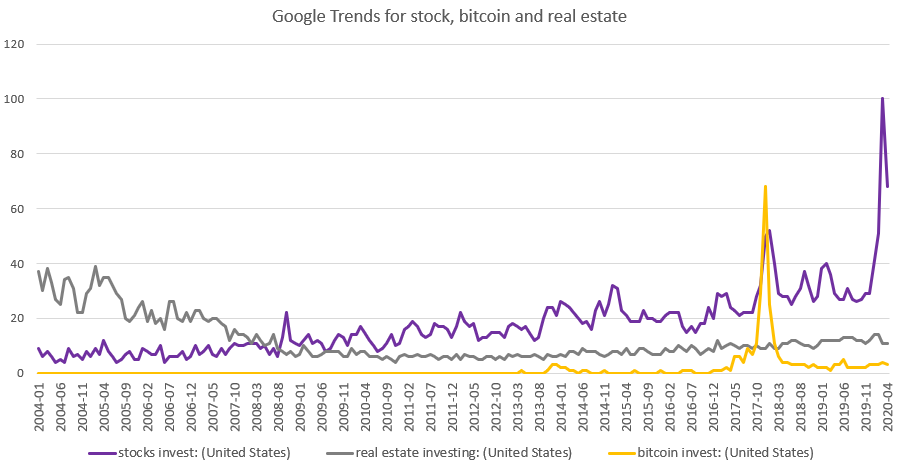

In previous posts (regarding equities, oil and bitcoin), I proposed that the retail investor is marginal buyer that push price higher. In this post, I suggest evidence that it is the case. First, from the FRED database, we can see that the saving rate is at a whooping 33%. How…

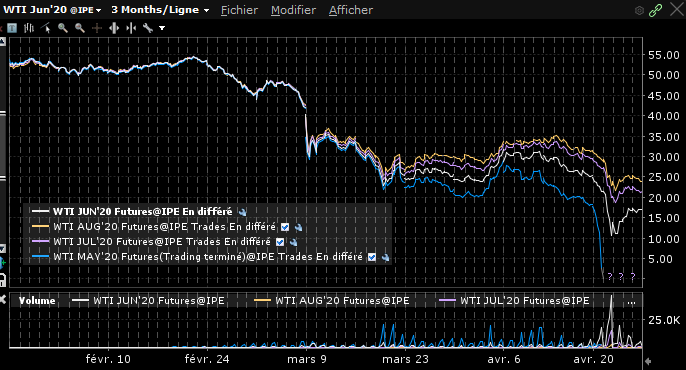

After bitcoin, shorting VIX, playing the Covid-19 rallye, the retail investors found a new interest in oil starting (and the USO ETP) April, 20 (first spike below) and mainly April, 21. That made sense, on April, 21 the May future for WTI ended at $-37 (pay attention to the minus…

While some are prognosticating a greatest depression (and a worldwide recession is a given), the S&P500 and the stock market in general stay steady. A year was lost for the US index, much more on the European side. On the valuation side, the PER is 21 and the Shiller PER…

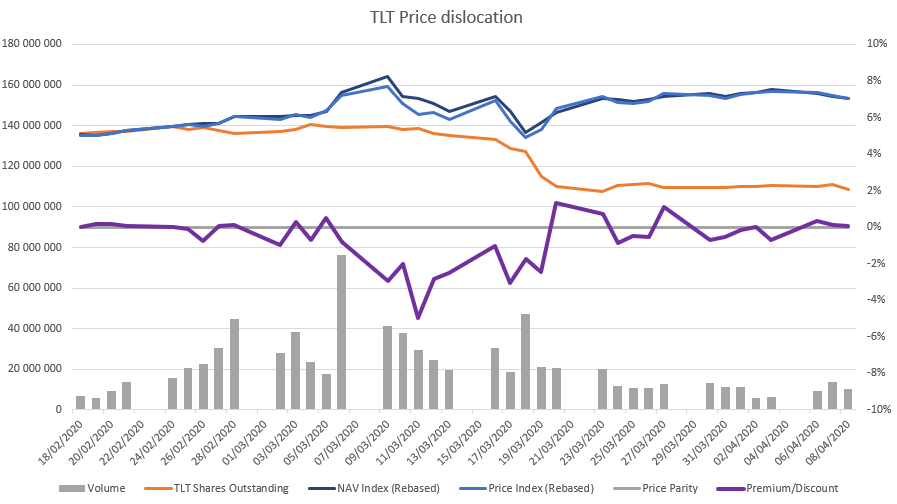

During the Covid-19, bonds ETF were under a stress and the ETF price started to diverge from the underlying NAV (Net Asset Value). Was the ETF price or the underlying NAV faulty? On the chart below, we can see that volume on TLT trading began to spike on March 6…

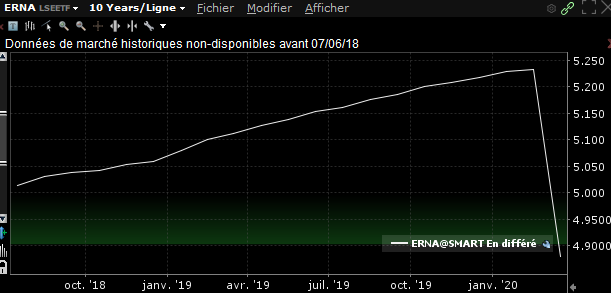

The current market dislocation provide some opportunities in bonds ETF. Big ETF trade are premium or discount because the underlying bonds are lacking of liquidity. ERNA is a US corporate investment grade ultra short term bonds trading on the London stock exchange. It is currently quoted $4.9 while the net…