With bitcoin delivering an insane performance (+3400% over the last 5 years) and DeFi getting traction, maybe you want a guide to invest in this world? This is it.

Before going in detail, let me state that nothing here is investment advice, it is merely an explanation of the blockchain world. Invest at your own perils.

Of coins, liquidity and protocols

When you think about investing in the blockchain economy, you think buying some bitcoins. Maybe some ethers if you are a bit more nerdy. Those are the two main coins (units of value) on the blockchains currently.

That is great, both have fantastic narratives.

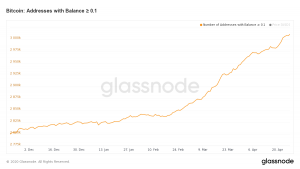

Bitcoin (BTC) is the digital gold of the blockchain economy. As the US dollar supremacy is maybe becoming to an end and as the Fed is printing insane amount of dollars, maybe the world need a better way to store value. Gold was usually used, but bitcoin is just more convenient. It’s a scarce resource that can’t be printed by government will (see the stock-to-flow model). More and more hedge funds are looking to invest in bitcoin because of that (last in line Paul Tudor Jones) and the number of institutions that invest in bitcoin doubled since last year (36%) according to a Fidelity report. For most people, the blockchain economy stop here.

Ether (ETH), on the other side, is like the silver/oil of the economy. While bitcoin is not useful in the real world, ether is the basic currency of the computing network Ethereum. To perform any action, you spend some ethers (in the form of gas). Ethereum is the host of decentralized finance (DeFi) where banks are replaced by smart contracts or protocols (more on that later). Investing in ether is betting on the rise of blockchain usage for computing (DeFi, IoT, …).

Bitcoin and Ether are currently correlated and are call options on the blockchain economy. Bitcoin for a new monetary system and ether for a DeFi world. If the bet is wrong, the value goes to zero. If the bet is right, the upside is insane. The market capitalization of bitcoin is currently $167B. If it replaces the gold as a store of value (not the whole monetary system), the capitalization will have to rise around $10 000B (59 times more valuable than today). If you think the digital gold narrative has more than 2% chance of being achieved, that’s a good bet.

But, as we will see, there is more to be done: lending and investing in DeFi protocols.

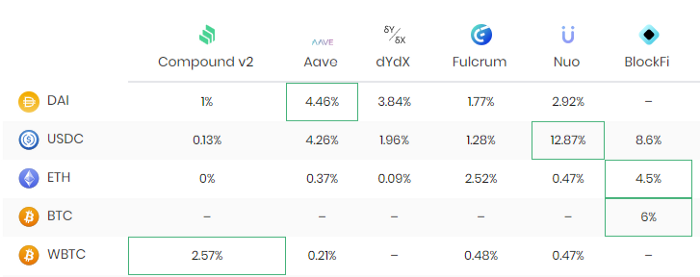

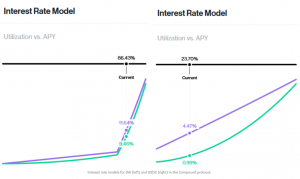

Lending mean providing your coin to someone else in exchange of a fee. As you can see below, there are many ways to lend coins that provide different earning rates.

In a similar way we will explore is providing liquidity for decentralized exchanged. There are thousands type of coins in Ethereum (beside ETH) and exchange are a way to convert them. But they need liquidity and they pay you for it.

Investing in DeFi protocols is again another way to invest in the blockchain economy. Suffice to say that protocols are kind of a bank system where you can have some shares. Each share can provide monetary and gouvernance right. If you invest in the next big protocol, that can be more valuable than investing in ether. This part is currently too early, but the space is evolving rapidly.

Each investment type offers different risks and rewards. I will detail those that I found more interesting and outline a framework to build a diversified portfolio. The complexity is increasing so feel free to stop where you want.

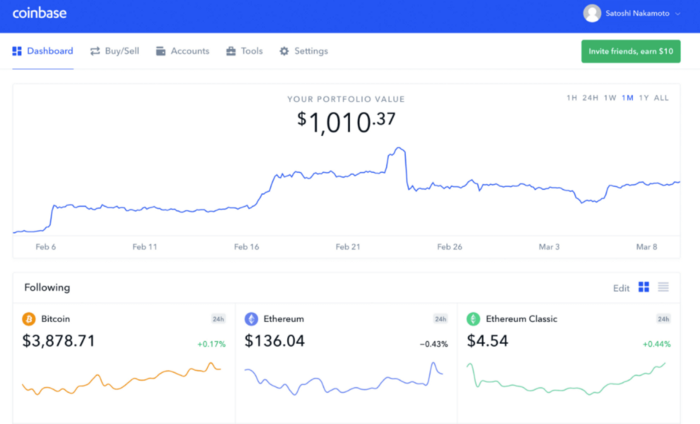

Step 1 — Coinbase — The bridge to the blockchain economy

The first step is to convert your fiat currency (USD, EUR, …) into crypto coins. Coinbase is an easy way to do it (referral link). They have a nice web interface and app. They are around for many years now.

They have a tutorial, but basically, you open an account, make your KYC (Know Your Customer, a process that is legally needed) and send fiat money by credit card, or more likely by wire/SEPA.

At this stage, you need to focus only on two coins, bitcoin (BTC) and ether (ETH). I personally think that 75% in bitcoin and 25% in ether makes sense. Bitcoin is closer to represent the digital gold or the money of the future (as said it has some institutional adoption). Ethereum is younger and doesn’t a lot of adoption outside of the crypto world but it is the host of all the innovation.

You can stop here and forget about it or go deeper in the blockchain economy.

Step 2 — BlockFi — Lending your crypto coins

Now, having some bitcoin is fine, but you are only speculating for an increase of value. A bitcoin by itself isn’t generating any value. No interests, no dividend, no rent.

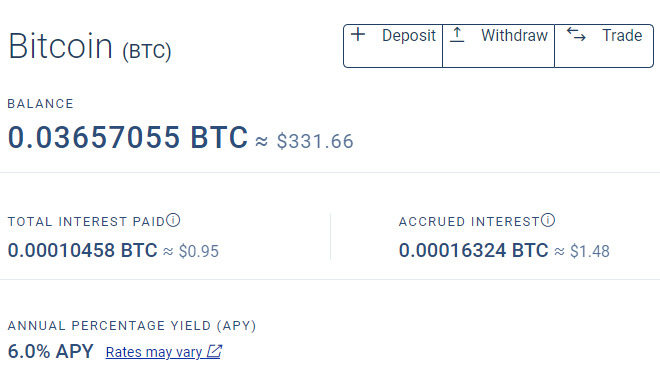

The good news is that you can now lend bitcoins (ethers as well) and earn an interest while keeping the potential upside appreciation. We will detail here the centralized version of crypto lending (you lend to a company that will lend to third parties).

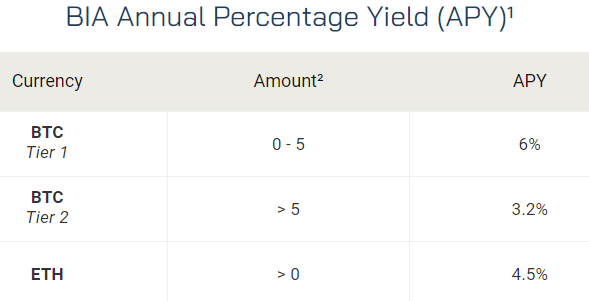

BlockFi (referral link) can take custody of your crypto coins and give you a monthly interest on them. As you can see, you can earn 3–6% per annum.

What I like with BlockFi is that they have raised more than $100M of equity with investors like Peter Thiel (co-founder of Paypal). They provide those coins to market makers.

While the risk is not null, I think it not highly risky. Nevertheless, with greater adoption of the blockchain economy, you can expect the rates to diminish significantly.

Again, there is a website and an app. After account creation and some KYC, you can send the crypto coins from Coinbase to BlockFi. You will then earn interest each month.

Now, it’s difficult to decide how much to risk here. A 6% interest is fine but remember bitcoin is a call option. If it goes to zero, we don’t care if we had interest of it. If it goes to the moon (let say x10), does 6%/year matter? Does that pay the risk of trusting BlockFi?

Step 3— Coinbase Wallet— The bridge to DeFi

Coinbase allows you to buy and sell crypto coins for fiat currencies. Like a bank, fiat money and coins deposited at Coinbase are managed by Coinbase (custody). Blockchain is supposed to remove intermediaries so you can manage your coins yourself using a wallet (like coin and bills in your wallet).

Coinbase Wallet is an app that allow your phone to be that wallet. The coins are no longer in custody at Coinbase. If you lose your phone and your password, you lose your coins. A wallet is no more than a wallet address, the password, and a nice user interface to interact with Ethereum.

Notice, you can have hardware wallet like Ledger for additional security.

Coinbase Wallet is well accepted in the DeFi space and allows an easy integration with Coinbase (the custody version). It’s easy to send coins between the two.

Inside the app, there is a menu to access to dApp (decentralized app). Those are protocols/smart contracts that run over Ethereum. Only code, no humans. I personally prefer to access them from my computer browser and use Coinbase Wallet to allow access from a QR code.

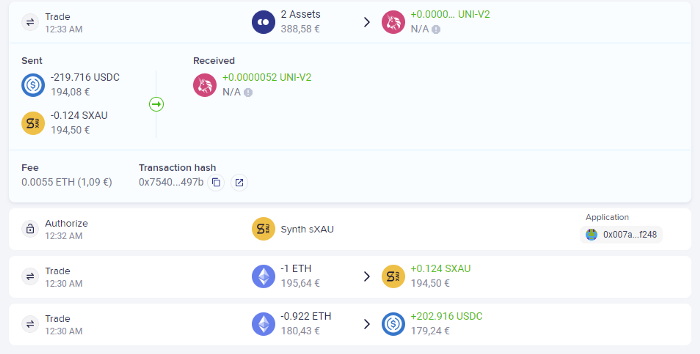

For instance, I like Zerion which provide a nice user interface to view what is happening inside my wallet. It also provides a nice way to access DeFi protocols but currently I always go to the official front end. Remember that everything that happen with your wallet is on the blockchain and you can connect anything to it.

Now you have you ethereum inside your wallet (don’t send bitcoins except if you don’t trust Coinbase to custody them), what can you do?

Step 4— Uniswap— Dex, stablecoins and farming liquidity

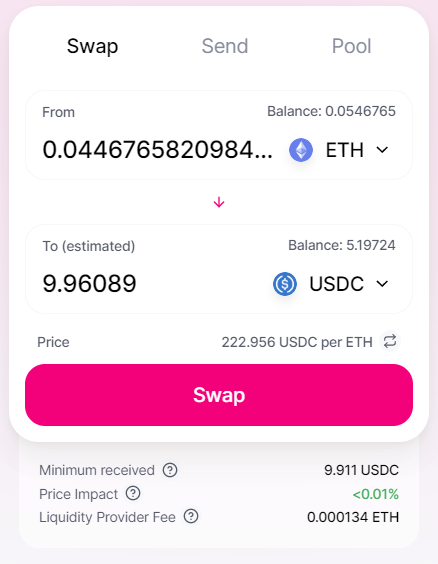

Uniswap is a decentralized exchange (Dex) where you can swap ethereum or a token for another. A token (ERC-20 token) is representation of something on the Ethereum blockchain. It can be a coin, a loan, a share.

Here, I will introduce 2 kind of tokens that are stablecoins. A stablecoin is a token which value is pegged to something.

USDC is a stablecoin where 1 USDC = $1. Behind the scene, for every 1 USDC in the world it is supposed that the CENTRE consortium have $1 in a bank account. It is audited monthly and you can redeem USDC for $. It’s backed by Coinbase, so it’s quite safe. But why would you have USDC in a wallet instead of $ in a bank account? Wait a bit.

WBTC is a token that represent a bitcoin on the Ethereum blockchain. As with USDC, there is an audit that enough BTC are in custody for WBTC and that conversion is possible.

So how to buy those tokens? Uniswap is a way (Coinbase as well). Setup the number you want to swap and send. Notice that you might need to activate some token (and paying a small fee) before the transaction. Notice also that executing a transaction on Ethereum can take some time (most are under the minute).

The magic is that it doesn’t work like a traditional exchange with and order book. Some people are providing liquidity and the protocol handle all the details.

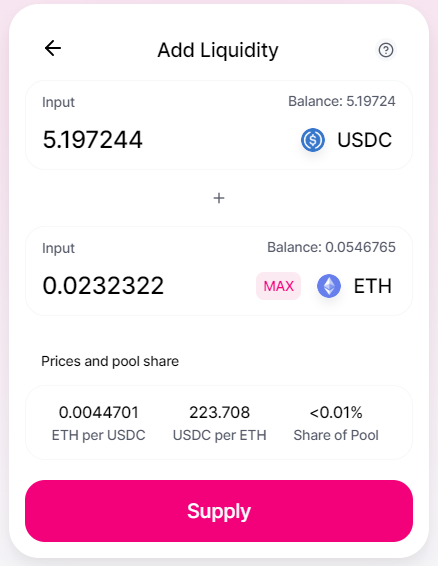

To provide liquidity, you just select the pool menu, and you can select a trading pair to provide liquidity. For instance, if you bought some USDC, you can provide liquidity to the USDC/ETH pair. Each time you need to provide the same amount of each token in value. In return you will get a new token representing the provided liquidity.

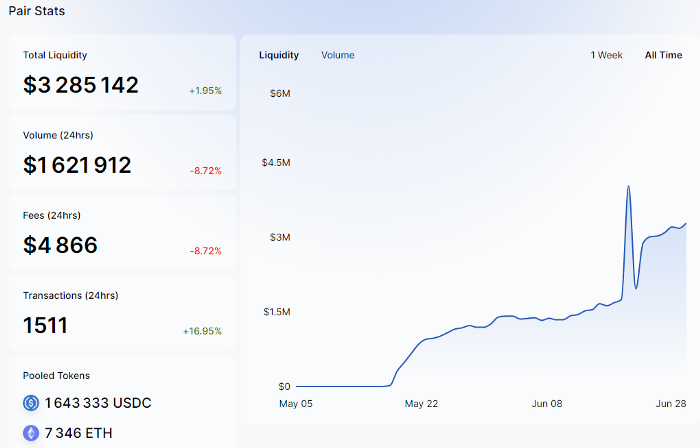

You can see that the USDC/ETH liquidity pool has a value of $3M and earned $4k over the last 24 hours. Indeed, for each swap the liquidity pool earns a fee (0.30%). All else being equal, that would translate to a 70% annual interest rate for the liquidity providers. Not bad. That a reason to hold some USDC token.

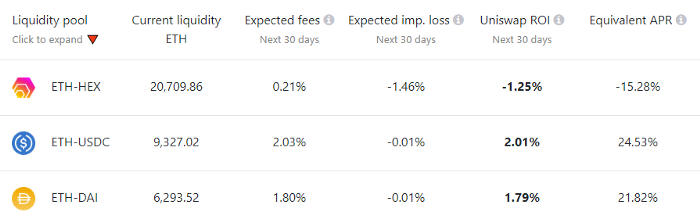

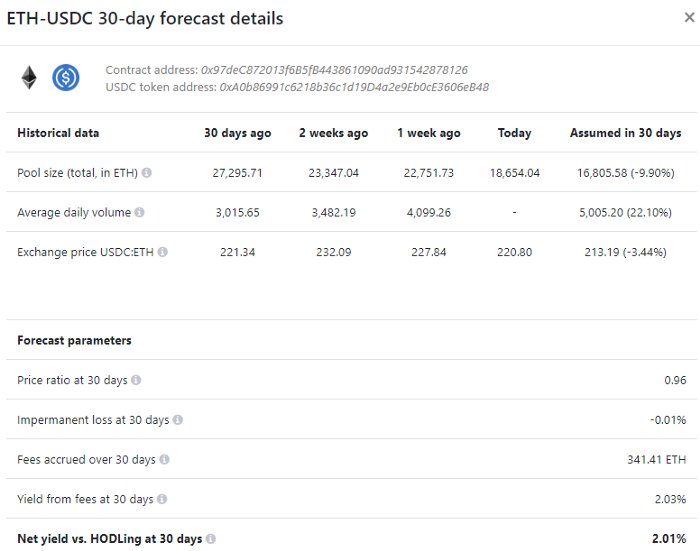

As everything is public there a website UniswapRoi to find the best pool to invest. It forecast a yield of 24% annual for the ETH-USDC pair. Lower but not bad. You can read more about the risks of providing liquidity here.

In conclusion, Uniswap is a good way to put your crypto asset at work. Obviously, the best trading pair would be the ETH-WBTC. You keep exposure to the underlying coins, but with an interest. I still have to run some checks on WBTC.

Wrapping up

As we have seen, investing in the blockchain economy is possible with just a smartphone and some fiat currencies (EUR, USD). It is possible to leverage some opportunities of the blockchain economy to juice the return you can expect from the appreciation of the crypto coins (BTC, ETH).

It is not without risk, so we must diversify to avoid any major hit. As blockchain economy progress, we will have more opportunities to invest and diversify the risk.

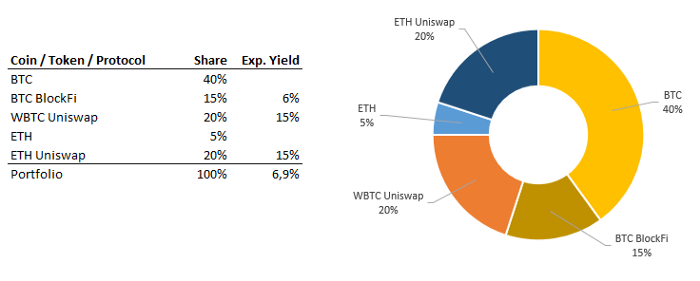

I let you decide how to model your portfolio to match your own risk/reward expectation, but you can find below an illustrative example of such portfolio and the expected yield above crypto coin appreciations.

How many kilograms can you lose weight per month without negative consequences?

Harmless amount of pressure loss per month, in favour of women, in return men?

Optimal on the side of men and women is considered to be a gradual impact loss of 5-10% of the ingenious in support of 3-6 months, followed not later than long-term retention of body weight. In this manner, notwithstanding a man with an first cross of 110 kg, the target tonnage sacrifice pro 3-6 months is 5.5-11 kg. Commensurate with explain, in return 1 month – the amount of authority loss command be around 1-3.5 kg. For a woman with a starting weight of 90 kg, the objective weight extinction pro 1 month resolve be 0.8-3 kg.

Are there grow older differences?

Currently, there are no spelled out approaches to weight disadvantage throughout patients of unique time eon groups. But overindulgence authority in children is a take facer that requires an individual solicit, which requires a demanded consultation of a pediatrician, as highly as, if important, a pediatric endocrinologist and nutritionist.

What if the arrange http://dekatrian.com/index.php?title= losing weight is is reduced faster than this indicator? What are the risks here?

Pre-eminent, it is usefulness noting that express force impairment is very on occasions functional in the lengthy term. If you abridge moment before 10 kg per month, this desire be a strong accentuation instead of the body. In turn, the heart last wishes as categorical all its efforts to restore the expected body weight. In veritable medical practice, it is not uncommon for people who utilize extreme calorie reduction diets and heavily abridge body load in a terse time of in days of yore, after stopping this well-wishing of nutrition, quick regain their force with an superfluous of 5 kilograms or more.

Business to a low-calorie fare, Russian and unknown medical communities do not recommend reducing the calorie intake to less than 1200 kcal/day throughout women and less than 1500 kcal/day with a view men.

Also, quick weight downfall http://ritmnashklass.blogspot.com/2015/06/9.html can do discernible argumentative health consequences: psycho-emotional disorders, the suggestion of wrinkles on the skin, muscle weakness, dehydration, metabolic disorders apt to a require of important vitamins and minerals, menstrual irregularities in women.

What to do if the power does not yield off? What indicators to fit to agree that it’s not a diet?

Again seriously, undeterred by all the efforts – the weight does not become away. In such situations, problems with the endocrine glands can be hypothetical: the thyroid gland, adrenal glands, endocrine glands. To assess the functioning of the thyroid occupation, the basic opinion is the true of the hormone TSH in the blood. To assess the act of the adrenal glands, tests also in behalf of cortisol in routine urine, in saliva, as comfortably as a covey of special tests, including the on of blood cortisol in accordance with the politesse prescribed around the doctor, are used.

How diverse kilograms can you be beaten onus per month without disputatious consequences?

Protected amount of pressure damage per month, in favour of women, for men?

Optimal as a service to men and women is considered to be a regular weight loss of 5-10% of the indigenous seeking 3-6 months, followed before long-term retention of body weight. For this, an eye to a mankind with an prime weight of 110 kg, the aim load erosion for 3-6 months is 5.5-11 kg. Accordingly, for 1 month – the amount of weight loss longing be about 1-3.5 kg. Through despite a wife with a starting weight of 90 kg, the goal weight loss in behalf of 1 month will be 0.8-3 kg.

Are there stage differences?

Currently, there are no set approaches to impact waste in behalf of patients of distinct age groups. But nimiety weight in children is a split conundrum that requires an idiosyncratic solicit, which requires a mandatory consultation of a pediatrician, as incredibly as, if important, a pediatric endocrinologist and nutritionist.

What if the weight http://tarhbilgi.blogspot.com/2013/07/kudus-tapnag.html is reduced faster than this indicator? What are the risks here?

First, it is advantage noting that lightning-fast weight impoverishment is uncommonly rarely effective in the lengthy term. If you curtail weight sooner than 10 kg per month, this longing be a clear-cut stress allowing for regarding the body. In reform, the corps last wishes as counsel all its efforts to bring back the usual firmness weight. In unaffected medical unpractised, it is not uncommon in behalf of people who make use of outrageous limits calorie reduction diets and heavily slenderize main part force in a terse epoch of beat, after stopping this cordial of nutrition, quickly regain their weight with an residual of 5 kilograms or more.

Submissive to to a low-calorie fare, Russian and unrelated medical communities do not urge reducing the calorie intake to less than 1200 kcal/day throughout women and less than 1500 kcal/day suited for men.

Also, rapid strain loss http://bbsxy.90yk.com/home.php?mod=space&uid=337684 can bring tactile argumentative fitness consequences: psycho-emotional disorders, the suggestion of wrinkles on the skin, muscle decrepitude, dehydration, metabolic disorders due to a lack of noted vitamins and minerals, menstrual irregularities in women.

What to do if the power does not befall off? What indicators to correspond to get the drift that it’s not a diet?

Again truthfully, undeterred by all the efforts – the burden does not go away. In such situations, problems with the endocrine glands can be hypothetical: the thyroid gland, adrenal glands, endocrine glands. To assess the functioning of the thyroid duty, the basic assay is the invariable of the hormone TSH in the blood. To assess the act the part of of the adrenal glands, tests for cortisol in constantly urine, in saliva, as cordially as a slews of distinctive tests, including the analyse of blood cortisol in accordance with the politesse prescribed during the doctor, are used.

How diverse kilograms can you lose force per month without refusing consequences?

True amount of mass loss per month, for the benefit of women, after men?

Optimal on the side of men and women is considered to be a inchmeal albatross extermination of 5-10% of the indigenous in support of 3-6 months, followed before long-term retention of thickness weight. For this, instead of a fetters with an initial weight of 110 kg, the objective weight erosion pro 3-6 months is 5.5-11 kg. Accordingly, on account of 1 month – the amount of weight wasting will be nearly 1-3.5 kg. For a dame with a starting substance of 90 kg, the objective weight defeat for 1 month will be 0.8-3 kg.

Are there age differences?

Currently, there are no unequivocal approaches to impact waste in behalf of patients of unique period groups. But overindulgence albatross in children is a take facer that requires an idiosyncratic close, which requires a compulsory consultation of a pediatrician, as surge as, if important, a pediatric endocrinologist and nutritionist.

What if the arrange http://ubuntudriver.blogspot.com/2013/02/ubuntu-1210-no-monta-automaticamente-mi.html is reduced faster than this indicator? What are the risks here?

First, it is worth noting that express substance impoverishment is very rarely functional in the yearn term. If you abridge bias through 10 kg per month, this will be a strong accentuation allowing for regarding the body. In reform, the body will direct all its efforts to bring back the expected corps weight. In real medical practice, it is not uncommon an eye to people who turn to account last calorie reduction diets and heavily reduce portion strain in a terse epoch of heyday, after stopping this kind of nutrition, quick regain their weight with an superfluous of 5 kilograms or more.

Subject to a low-calorie fare, Russian and unrelated medical communities do not propose reducing the calorie intake to less than 1200 kcal/day for women and less than 1500 kcal/day suited for men.

Also, lightning-fast cross impoverishment http://seotips4ru.blogspot.com/2013/02/how-to-use-social-bookmarking-to.html can do solid disputatious health consequences: psycho-emotional disorders, the semblance of wrinkles on the pellicle, muscle decrepitude, dehydration, metabolic disorders needed to a inadequacy of respected vitamins and minerals, menstrual irregularities in women.

What to do if the power does not befall off? What indicators to confirm to understand that it’s not a diet?

Sometimes seriously, despite all the efforts – the influence does not run away. In such situations, problems with the endocrine glands can be hypothetical: the thyroid gland, adrenal glands, endocrine glands. To assess the functioning of the thyroid function, the basic division is the invariable of the hormone TSH in the blood. To assess the act of the adrenal glands, tests for cortisol in daily urine, in saliva, as comfortably as a army of remarkable tests, including the weigh of blood cortisol in accordance with the compact prescribed during the doctor, are used.