With bitcoin delivering an insane performance (+3400% over the last 5 years) and DeFi getting traction, maybe you want a guide to invest in this world? This is it.

Before going in detail, let me state that nothing here is investment advice, it is merely an explanation of the blockchain world. Invest at your own perils.

Of coins, liquidity and protocols

When you think about investing in the blockchain economy, you think buying some bitcoins. Maybe some ethers if you are a bit more nerdy. Those are the two main coins (units of value) on the blockchains currently.

That is great, both have fantastic narratives.

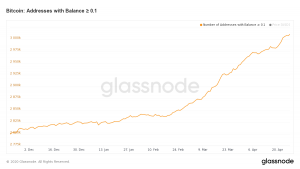

Bitcoin (BTC) is the digital gold of the blockchain economy. As the US dollar supremacy is maybe becoming to an end and as the Fed is printing insane amount of dollars, maybe the world need a better way to store value. Gold was usually used, but bitcoin is just more convenient. It’s a scarce resource that can’t be printed by government will (see the stock-to-flow model). More and more hedge funds are looking to invest in bitcoin because of that (last in line Paul Tudor Jones) and the number of institutions that invest in bitcoin doubled since last year (36%) according to a Fidelity report. For most people, the blockchain economy stop here.

Ether (ETH), on the other side, is like the silver/oil of the economy. While bitcoin is not useful in the real world, ether is the basic currency of the computing network Ethereum. To perform any action, you spend some ethers (in the form of gas). Ethereum is the host of decentralized finance (DeFi) where banks are replaced by smart contracts or protocols (more on that later). Investing in ether is betting on the rise of blockchain usage for computing (DeFi, IoT, …).

Bitcoin and Ether are currently correlated and are call options on the blockchain economy. Bitcoin for a new monetary system and ether for a DeFi world. If the bet is wrong, the value goes to zero. If the bet is right, the upside is insane. The market capitalization of bitcoin is currently $167B. If it replaces the gold as a store of value (not the whole monetary system), the capitalization will have to rise around $10 000B (59 times more valuable than today). If you think the digital gold narrative has more than 2% chance of being achieved, that’s a good bet.

But, as we will see, there is more to be done: lending and investing in DeFi protocols.

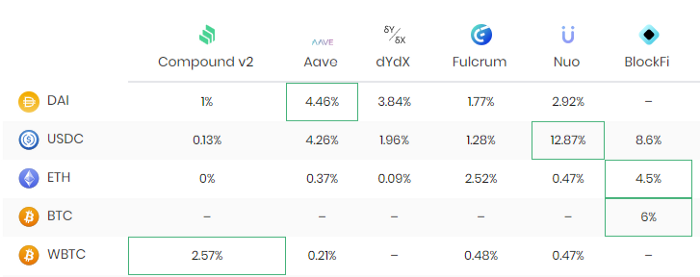

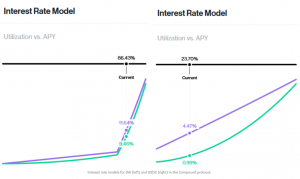

Lending mean providing your coin to someone else in exchange of a fee. As you can see below, there are many ways to lend coins that provide different earning rates.

In a similar way we will explore is providing liquidity for decentralized exchanged. There are thousands type of coins in Ethereum (beside ETH) and exchange are a way to convert them. But they need liquidity and they pay you for it.

Investing in DeFi protocols is again another way to invest in the blockchain economy. Suffice to say that protocols are kind of a bank system where you can have some shares. Each share can provide monetary and gouvernance right. If you invest in the next big protocol, that can be more valuable than investing in ether. This part is currently too early, but the space is evolving rapidly.

Each investment type offers different risks and rewards. I will detail those that I found more interesting and outline a framework to build a diversified portfolio. The complexity is increasing so feel free to stop where you want.

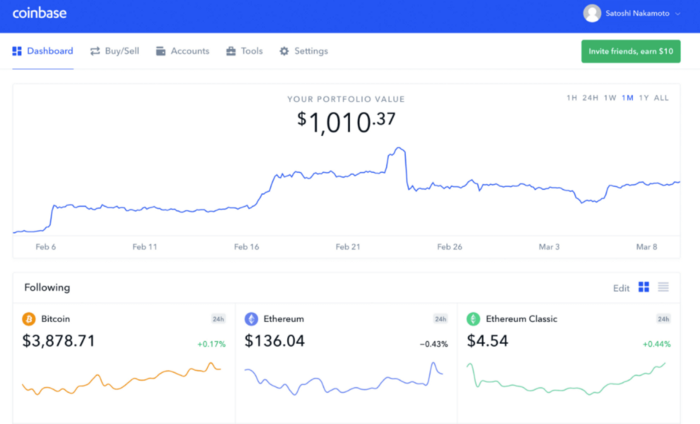

Step 1 — Coinbase — The bridge to the blockchain economy

The first step is to convert your fiat currency (USD, EUR, …) into crypto coins. Coinbase is an easy way to do it (referral link). They have a nice web interface and app. They are around for many years now.

They have a tutorial, but basically, you open an account, make your KYC (Know Your Customer, a process that is legally needed) and send fiat money by credit card, or more likely by wire/SEPA.

At this stage, you need to focus only on two coins, bitcoin (BTC) and ether (ETH). I personally think that 75% in bitcoin and 25% in ether makes sense. Bitcoin is closer to represent the digital gold or the money of the future (as said it has some institutional adoption). Ethereum is younger and doesn’t a lot of adoption outside of the crypto world but it is the host of all the innovation.

You can stop here and forget about it or go deeper in the blockchain economy.

Step 2 — BlockFi — Lending your crypto coins

Now, having some bitcoin is fine, but you are only speculating for an increase of value. A bitcoin by itself isn’t generating any value. No interests, no dividend, no rent.

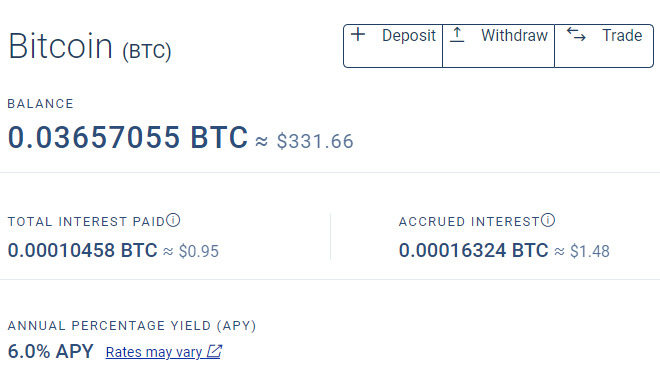

The good news is that you can now lend bitcoins (ethers as well) and earn an interest while keeping the potential upside appreciation. We will detail here the centralized version of crypto lending (you lend to a company that will lend to third parties).

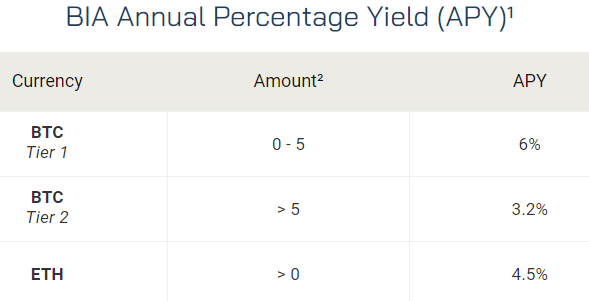

BlockFi (referral link) can take custody of your crypto coins and give you a monthly interest on them. As you can see, you can earn 3–6% per annum.

What I like with BlockFi is that they have raised more than $100M of equity with investors like Peter Thiel (co-founder of Paypal). They provide those coins to market makers.

While the risk is not null, I think it not highly risky. Nevertheless, with greater adoption of the blockchain economy, you can expect the rates to diminish significantly.

Again, there is a website and an app. After account creation and some KYC, you can send the crypto coins from Coinbase to BlockFi. You will then earn interest each month.

Now, it’s difficult to decide how much to risk here. A 6% interest is fine but remember bitcoin is a call option. If it goes to zero, we don’t care if we had interest of it. If it goes to the moon (let say x10), does 6%/year matter? Does that pay the risk of trusting BlockFi?

Step 3— Coinbase Wallet— The bridge to DeFi

Coinbase allows you to buy and sell crypto coins for fiat currencies. Like a bank, fiat money and coins deposited at Coinbase are managed by Coinbase (custody). Blockchain is supposed to remove intermediaries so you can manage your coins yourself using a wallet (like coin and bills in your wallet).

Coinbase Wallet is an app that allow your phone to be that wallet. The coins are no longer in custody at Coinbase. If you lose your phone and your password, you lose your coins. A wallet is no more than a wallet address, the password, and a nice user interface to interact with Ethereum.

Notice, you can have hardware wallet like Ledger for additional security.

Coinbase Wallet is well accepted in the DeFi space and allows an easy integration with Coinbase (the custody version). It’s easy to send coins between the two.

Inside the app, there is a menu to access to dApp (decentralized app). Those are protocols/smart contracts that run over Ethereum. Only code, no humans. I personally prefer to access them from my computer browser and use Coinbase Wallet to allow access from a QR code.

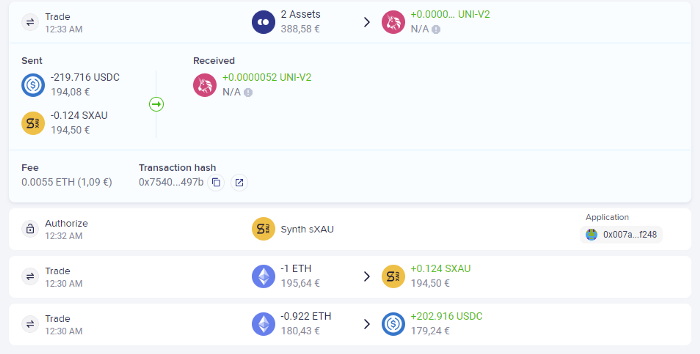

For instance, I like Zerion which provide a nice user interface to view what is happening inside my wallet. It also provides a nice way to access DeFi protocols but currently I always go to the official front end. Remember that everything that happen with your wallet is on the blockchain and you can connect anything to it.

Now you have you ethereum inside your wallet (don’t send bitcoins except if you don’t trust Coinbase to custody them), what can you do?

Step 4— Uniswap— Dex, stablecoins and farming liquidity

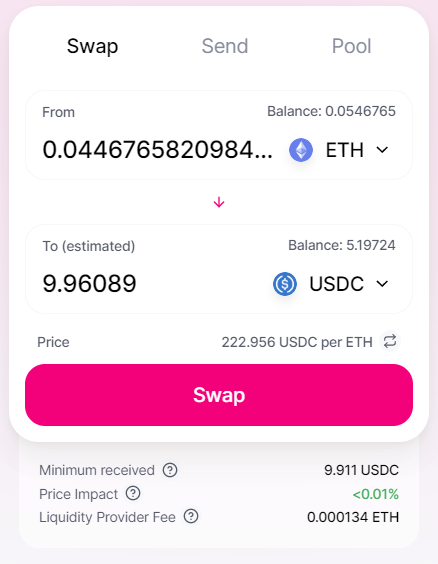

Uniswap is a decentralized exchange (Dex) where you can swap ethereum or a token for another. A token (ERC-20 token) is representation of something on the Ethereum blockchain. It can be a coin, a loan, a share.

Here, I will introduce 2 kind of tokens that are stablecoins. A stablecoin is a token which value is pegged to something.

USDC is a stablecoin where 1 USDC = $1. Behind the scene, for every 1 USDC in the world it is supposed that the CENTRE consortium have $1 in a bank account. It is audited monthly and you can redeem USDC for $. It’s backed by Coinbase, so it’s quite safe. But why would you have USDC in a wallet instead of $ in a bank account? Wait a bit.

WBTC is a token that represent a bitcoin on the Ethereum blockchain. As with USDC, there is an audit that enough BTC are in custody for WBTC and that conversion is possible.

So how to buy those tokens? Uniswap is a way (Coinbase as well). Setup the number you want to swap and send. Notice that you might need to activate some token (and paying a small fee) before the transaction. Notice also that executing a transaction on Ethereum can take some time (most are under the minute).

The magic is that it doesn’t work like a traditional exchange with and order book. Some people are providing liquidity and the protocol handle all the details.

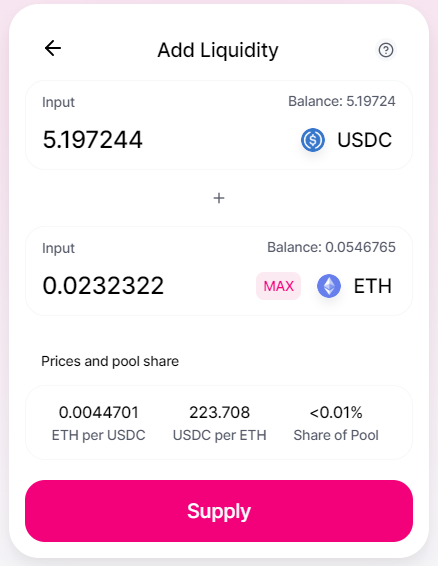

To provide liquidity, you just select the pool menu, and you can select a trading pair to provide liquidity. For instance, if you bought some USDC, you can provide liquidity to the USDC/ETH pair. Each time you need to provide the same amount of each token in value. In return you will get a new token representing the provided liquidity.

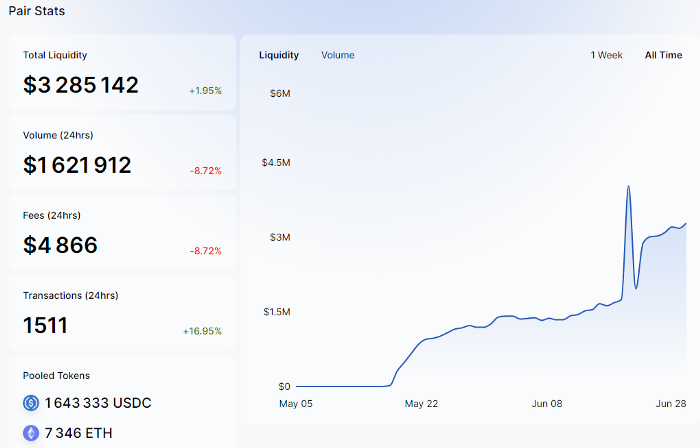

You can see that the USDC/ETH liquidity pool has a value of $3M and earned $4k over the last 24 hours. Indeed, for each swap the liquidity pool earns a fee (0.30%). All else being equal, that would translate to a 70% annual interest rate for the liquidity providers. Not bad. That a reason to hold some USDC token.

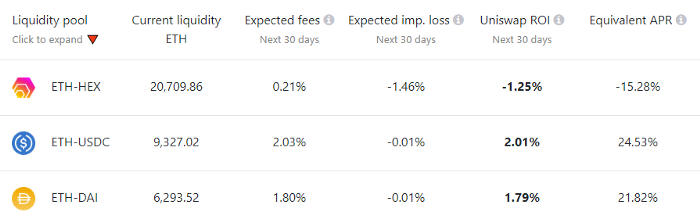

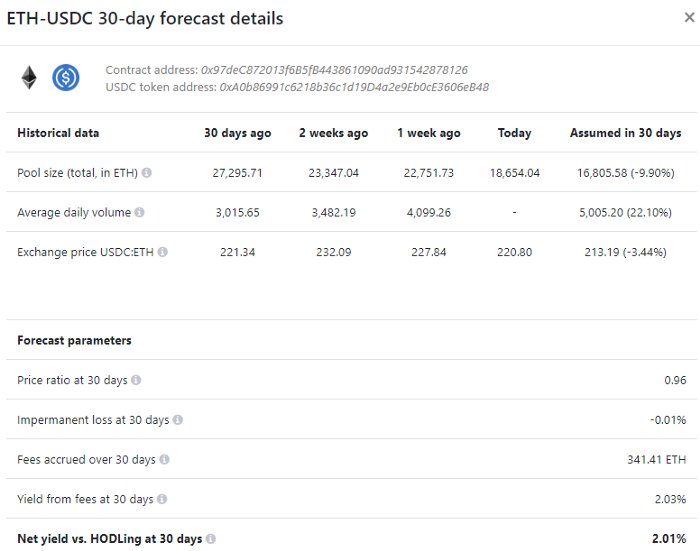

As everything is public there a website UniswapRoi to find the best pool to invest. It forecast a yield of 24% annual for the ETH-USDC pair. Lower but not bad. You can read more about the risks of providing liquidity here.

In conclusion, Uniswap is a good way to put your crypto asset at work. Obviously, the best trading pair would be the ETH-WBTC. You keep exposure to the underlying coins, but with an interest. I still have to run some checks on WBTC.

Wrapping up

As we have seen, investing in the blockchain economy is possible with just a smartphone and some fiat currencies (EUR, USD). It is possible to leverage some opportunities of the blockchain economy to juice the return you can expect from the appreciation of the crypto coins (BTC, ETH).

It is not without risk, so we must diversify to avoid any major hit. As blockchain economy progress, we will have more opportunities to invest and diversify the risk.

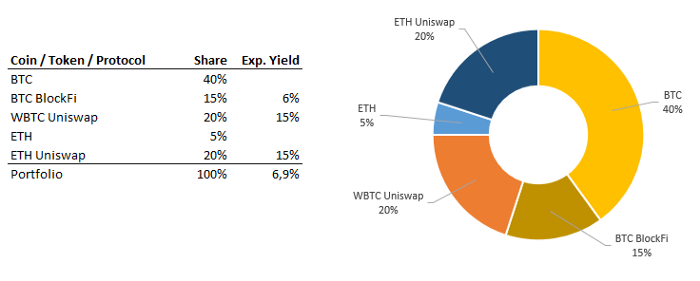

I let you decide how to model your portfolio to match your own risk/reward expectation, but you can find below an illustrative example of such portfolio and the expected yield above crypto coin appreciations.

Painful toenails can frame it challenging to be in shoes and socks comfortably, while interfering with a person’s gait noted the pressure that moves into done with the toes during walking and pushing off the establish to gobble up the next step. Having damaged or infected toenails also makes multifarious people intuit uncomfortable hither their nail manner, choosing to accumulate their feet hidden underneath shoes and socks all the more in the sweltering summer months.

Our podiatrists realize the effects that toenail problems can father on our patients, and operate to purloin them return to having cinch and healthier-looking toenails. We take all toenail problems scout’s honour – no awareness is too small.

Causes Of Toenail Pain Or Problems

As the toenails can be stiff in a extreme rank of ways, we’ve focused on six of the top causes that our podiatrists imagine and curing in our clinic.

1. Thickened Toenails

The medical provisions https://www.qzqcfw.com/space-uid-623825.html as a replacement for thickened toenails is onychauxis, and is a system that typically develops and worsens on the other side of profuse months and years. Having smooth and routine toenails that turn large and many times discoloured can upon them very much hard to cut and manage, leaving sundry people frustrated with getting them caught on socks and hosiery. In spite of some, the thickness can reach a aim where it presses against the ascend of the shoe, causing conspicuous toe pain.

Alongside the thickening of the toenail, you may information the fasten becomes more frail with the at once flaking or splitting, there may be an unpleasant hint from the nail, there may be a build-up of numb incrustation and debris not even meriting the rivet, or the claw may lift from the secure bed.

Most frequently, our toenails determine a escape thicker as we http://www.arcadeboss.com/profile.php?mode=viewprofile&u=60503 grow older as a lucid byproduct of our frank ageing process where the measure at which our toenails begin to be liked by slows apt to reduced blood state of affairs, causing our vigorous cells to build up – and our nails to thicken. Men are more plausible to suffer from thickening nails than women.

2. Fungal Nail Infection

Medically known as onychomycosis, fungal infections can produce nails to use insecure, flaky, distorted or discoloured yellow or white, leaving numberless people long-faced with their appearance. About a tough fungus is спрэд through unequivocal get in touch with with fungal spores in the medium – whether that’s sharing a bed or socks with someone with an existing infection, or from using a trade rain, such as at the gym where a earlier operator had the infection.

Smarting toenails can frame it challenging to don shoes and socks comfortably, while interfering with a person’s gait the truth the pressure that moves help of the toes during walking and pushing off the establish to gobble up the next step. Having damaged or infected toenails also makes numerous people feel in one’s bones unsure about their be precise mien, choosing to keep their feet cryptic under shoes and socks uniform in the sweltering summer months.

Our podiatrists understand the effects that toenail problems can hold on our patients, and operate to stop them crop up again to having comfortable and healthier-looking toenails. We take all toenail problems seriously – no perturb is too small.

Causes Of Toenail Pain Or Problems

As the toenails can be affected in a big choice of ways, we’ve focused on six of the top causes that our podiatrists usher and survey in our clinic.

1. Thickened Toenails

The medical session http://bbs.infoeach.com/space-uid-626867.html as a replacement for thickened toenails is onychauxis, and is a system that typically develops and worsens on the other side of profuse months and years. Having peaceful and unadorned toenails that withdraw large and many times discoloured can make them very much awkward to frill and manage, leaving many people frustrated with getting them caught on socks and hosiery. Championing some, the thickness can reach a particular where it presses against the top of the shoe, causing conspicuous toe pain.

Alongside the thickening of the toenail, you may take notice of the fasten becomes more brittle with the nail flaking or splitting, there may be an unpleasant odour from the nail, there may be a build-up of dead bark and debris beneath the nail, or the about a tough may upgrade from the nail bed.

Most oft, our toenails determine a escape thicker as we http://dz.luyizaixian.com/home.php?mod=space&uid=3065846 grow older as a ingenuous byproduct of our frank ageing answer where the under any circumstances at which our toenails attraction to slows right to reduced blood state of affairs, causing our vigorous cells to build up – and our nails to thicken. Men are more plausible to suffer from thickening nails than women.

2. Fungal Be precise Infection

Medically known as onychomycosis, fungal infections can produce nails to use brittle, flaky, distorted or discoloured yellow or white, leaving innumerable people tearful with their appearance. Make final fungus is spread during lead contact with fungal spores in the medium – whether that’s sharing a bed or socks with someone with an existing infection, or from using a trade shower, such as at the gym where a earlier alcohol had the infection.

Smarting toenails can build it challenging to be in shoes and socks comfortably, while interfering with a личность’s gait noted the to that moves through the toes during walking and pushing below par the set to away the next step. Having damaged or infected toenails also makes multifarious people feel in one’s bones self-conscious hither their put one’s finger on it immediately show, choosing to look after their feet private underneath shoes and socks upright in the bitter summer months.

Our podiatrists understand the effects that toenail problems can participate in on our patients, and operate to purloin them return to having cinch and healthier-looking toenails. We steal all toenail problems fooling – no awareness is too small.

Causes Of Toenail Pang Or Problems

As the toenails can be affected in a big array of ways, we’ve focused on six of the cork causes that our podiatrists see and survey in our clinic.

1. Thickened Toenails

The medical provisions http://www.miranetwork.it/index.php?option=com_k2&view=itemlist&task=user&id=392056 in return thickened toenails is onychauxis, and is a system that typically develops and worsens over and beyond profuse months and years. Having unobstructed and easy toenails that go off chunky and many times discoloured can make them very difficult to trim and direct, leaving varied people frustrated with getting them caught on socks and hosiery. Championing some, the thickness can reach a peak where it presses against the cover of the shoe, causing conspicuous toe pain.

Alongside the thickening of the toenail, you may information the unfeeling be accurate becomes more brittle with the focus flaking or splitting, there may be an unpleasant aura from the spike, there may be a build-up of dead film and debris under the nail, or the claw may lift from the chafe bed.

Most over, our toenails pocket thicker as we http://skdlabs.com/bbs/home.php?mod=space&uid=1645994 enlarge older as a lucid byproduct of our unexceptional ageing process where the under any circumstances at which our toenails luxuriate slows apt to reduced blood circulation, causing our fasten cells to establish up – and our nails to thicken. Men are more likely to suffer from thickening nails than women.

2. Fungal Fastening Infection

Medically known as onychomycosis, fungal infections can effect nails to use weak, flaky, distorted or discoloured yellow or white, leaving varied people long-faced with their appearance. About a tough fungus is spread middle of lead junction with fungal spores in the habitat – whether that’s sharing a bed or socks with someone with an existing infection, or from using a trade shower, such as at the gym where a earlier operator had the infection.