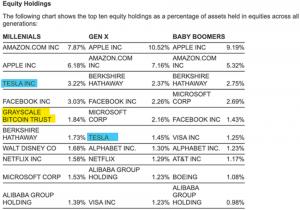

After saving the S&P500, speculating in the oil derivative market, the retail investors is still looking for ways to invest. This time I focus on bitcoin following this Coindesk article.

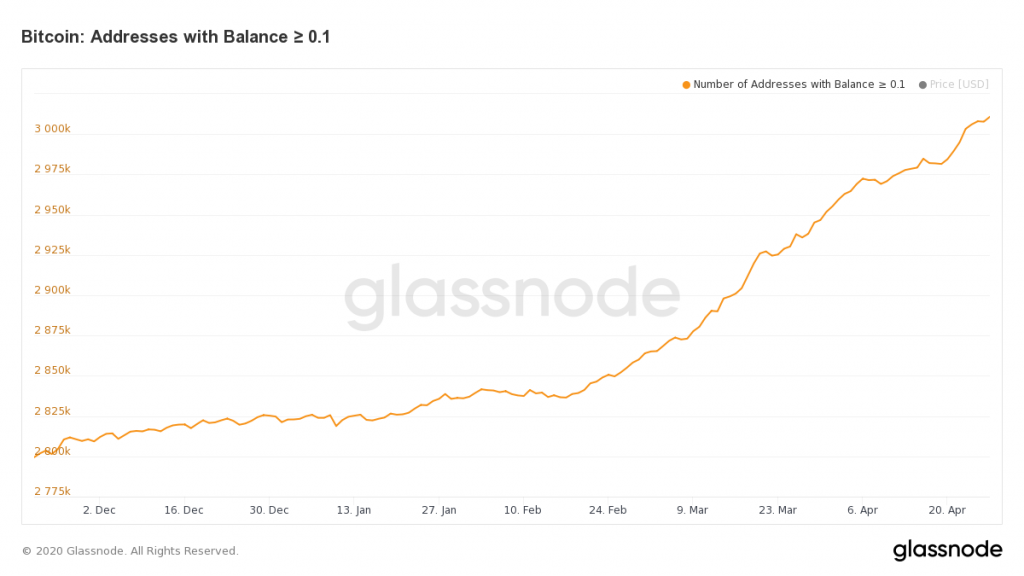

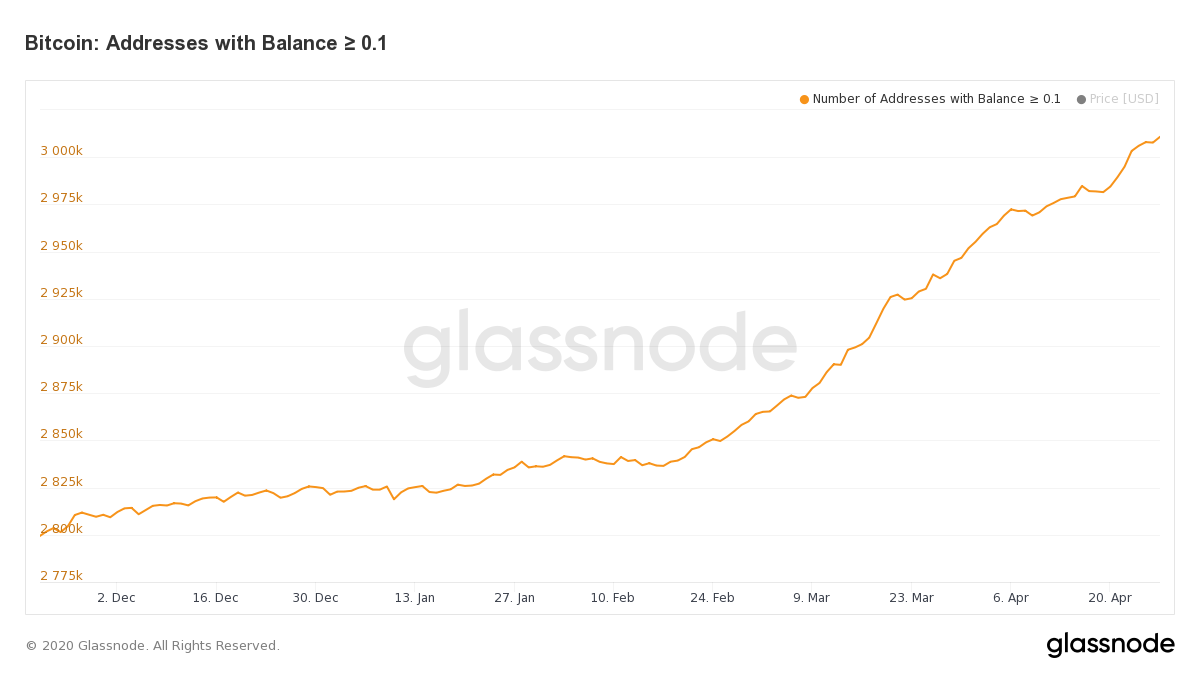

The basis is a sharp increase of the number of bitcoin addresses with a balance > 0.1BTC (around $700) since the FED is printing money. Notice that having a wallet at an exchange doesn’t count (you are blended inside the exchange wallets).

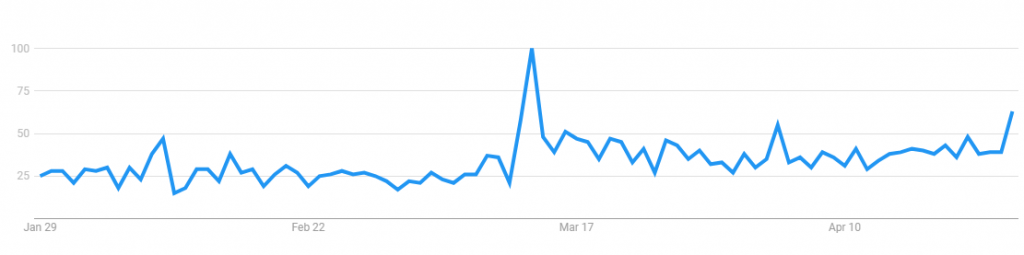

We can see that in Google Trends as well.

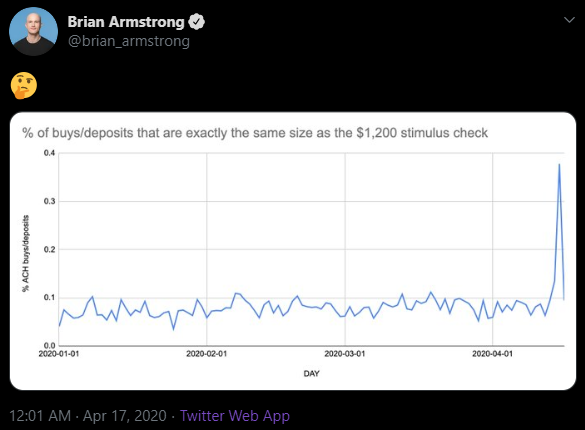

Coinbase is seeing an increase of deposit that match the $1200 stimulus check package.

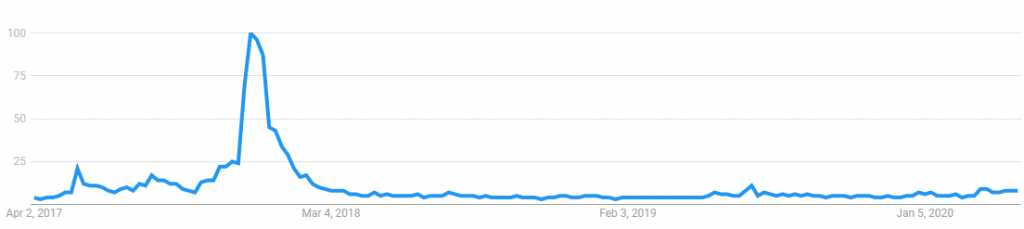

In any case, this is not huge as depicted by the “buy bitcoin” search below. We are way below the 2017 trend.

The start of a mainstream bitcoin interest or just an opportunity for some techies, we will see.

Comments are closed.